Assignment Management

Assignment Management

Assignment Management is used by the HR Managers to organize and manage the employee’s assigned work and calculate their expected salaries.

Assignment Management includes three main components: Employee Assignment, Temporary Position, and Accumulated Benefit Summary.

Employee Assignment

HR Managers use Employee Assignment to view all assignments of an employee from history to current. Managers can assign multiple assignments to different employees at the same time.

Under Employee Assignment HR managers can:

- Attach documents in XML format using the Attachment tab. These documents can be the assignment description or information about the employee

- HR Managers use Salary Transitions tab to view the salary history of the employee taking on the assignment. An assignment must have a minimum of one salary transition in the employee’s file. Salary Transitions records are also used by payroll calculation.

- Automatic Cost Items: When an employee’s pay is calculated, the system identifies all cost items/allowances which have been defined for that employee for the pay period. The gross amount credited to the employee is determined by the sum of all earnings applicable to the pay period.

- Automatic Deductions: HR managers use Automatic Deductions to personalize an employee’s deduction by removing the deductions that do not apply to the assignment or by adding new ones or even override the values inherited from the deduction definition.

Temporary Position

Temporary Position is used by HR to assign short-term assignments to individual employees. Temporary Position is linked to the Leave and Promotion components.

Accumulated Benefit Summary

HR Managers use Accumulated Benefit Summary to review collected overtime employee benefits and various non-wage compensations provided to employees in addition to their normal wages or salaries. Accumulated Benefit Summary is maintained by the payroll calculation and it’s available for view by the HR Managers.

Employee Assignment

Overview

The Employee Assignment screen is used to connect an employee to an employee position. This screen contains the information used by the payroll engine to calculate an employee’s pay.

To view the Employee Assignment

Go to: Human Resources > Employee Management > Assignment Management > Employee Assignment

- Click on the Find

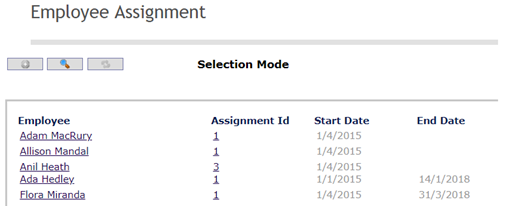

icon to do a general search. The engine will bring up all employee assignments that are current and past. Example:

icon to do a general search. The engine will bring up all employee assignments that are current and past. Example:

- Click on the hyperlink, example

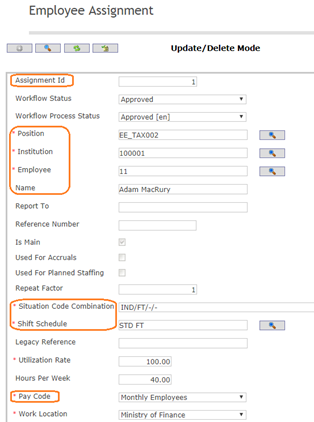

- You can view the employee assignment details, like

a. Employee Assignment Id

b. Employee Institution

c. Employee Position

d. Situation Code Combination (type of employment conditions)

e. Shift Schedule

f. Pay Code, etc.

Example:

Note. The manager has limited access to view the records, so he cannot update nor change the information contained on the Employee and Employee Assignment Forms.

Assignment Financial Coding Blocks

Overview

The Assignment Financial Coding Blocks Tab lists the coding block that is to be used for the assignment. This information overrides the coding block from the Position Financial Coding Blocks Tab.

Assignment Financial Coding Blocks screen fields

| Fields | Description |

| Percentage | The percentage amount to be taken from the specified coding block. |

| Coding Block | The details of the fund from which the assignment is paid from. |

Attachment

Overview

To attach any to support file for the employee assignment process.

Attachment screen Fields

Field | Description |

ID | Consecutive number auto generated by the system. It will be unique within the system. |

| Attachment Classification | Reference to attachment classification. |

Language | Country-specific language for the title and description. |

Title | Title of the Attachments. |

Description | Description of the attachments. |

Attachment | System allow to selete and upload supporting file. File type can be: pdf, doc, xls, jpg, etc. |

Date Time | Date and Time of the last operation performed on the attachment document. Visible for the user. Automatically assigned by the system. |

User | Last user who uploaded or updated the document. Visible for the user. Automatically assigned by the system. |

Language | Mandatory field, language of the document. The system will suggest the default language; however the user can change such language. |

Automatic Cost Item

Overview

This tab allows assigning automatic cost items to the employee assignment.

Automatic Cost Item screen fields

| Fields | Description |

| Cost Item | Cost item for the automatic cost item |

| Start Date | Start date of the automatic cost item, when the automatic cost item going to affect. |

| End Date | End of the automatic cost item. |

| Is For Previous Earning Period | Check True if the automatic cost item was part of Previous Earning Period. |

| Number Of Hours Or Days | If the automatic cost item applicable for a particular time. |

| Maximum Per Pay | Maximum amount per day. |

| Annual Maximum Amount | Maximum annual amount of the Automatic cost item. |

| Language | The language used to enter the Explanation. |

| Explanation | Description field to enter any explanation regarding the automatic cost item. |

| Attachment Tab | Any attachment to support the Automatic cost item. |

Automatic Deduction

Overview

The Automatic Deductions Tab lists the automatic cost items that have taken place throughout the assignment. Automatic Deductions that are assigned to Shift Schedule Definitions are automatically added and displayed.

Automatic Deduction screen fields

| Fields | Description |

| Deduction | The unique identification code of the deduction. |

| Deduction Start Date | The date the deduction becomes effective. |

| Deduction End Date | The date the deduction is no longer effective, if applicable. |

| Reference Number | Any reference number of the automatic deduction. |

| Automatic Deduction Updater | Linked to importing loans. |

| Vendor | The vendor code needs to be inserted in this field. |

| Is In Arrears | If checked, Deduction is deferred. |

| Amount | A Deduction amount that is retrieved from the Deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

| Rate | Percentage Rate of Deduction that is retrieved from the Deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

| Exemption | Exemption amount before this deduction is to be applied. This value is retrieved from the Deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

| Minimum Salary | Minimum salary for this deduction to be applied to. This value is retrieved from the Deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

| Language | The language used to enter the explanation. |

| Explanation | Detailed description as to why the Automatic Deductions was customized. |

| Attachments Attachments Tab | Deductions can have 0 or more documents attached to it. |

| Automatic Deduction Cost Item Tab | This tab used to enter Automatic Deduction Cost Item. |

Employee Assignment Penalties

Overview

The Employee Assignment Penalties Tab maintains the information for all Employee Penalties incurred.

Employee Assignment Penalties screen fields

| Fields | Description |

| Employee Assignment Penalty State | State of the penalty. By default always be created. This generates a change request for the assignment and the status is updated to Approve or Rejected once the change request has been updated |

| Pay Period | The pay period to which the penalty applies |

| Penalty Rate | The percentage amount that is to be deducted from the pay period the penalty applies to. |

Position Financial Coding Blocks

Overview

The Position Financial Coding Blocks Tab lists the coding block that is linked to the Employee Position of the assignment.

Position Financial Coding Blocks screen fields

| Fields | Description |

| Percentage | The percentage amount to be taken from the specified coding block. |

| Coding Block | The details of the fund from which the assignment is paid from. |

Salary Transitions

Overview

This gives the salary history of the employee. An assignment must have a minimum of 1 salary transition in his file. May have many salary transitions.

Salary Transitions screen fields

| Fields | Description |

| Is OffScale | Users are required to manually set it true if he wishes to enter an amount. |

| Group | One salary transition can have 1 salary group. This is a drop-down menu to show the list of the group. |

| Classification | This is the cost item scale of the employee salary. |

| Salary Step | Cost item scale step of the employee salary. This is a drop-down menu to show the list of the scale step. |

| Amount | Amount of salary. updated automatically. |

Temporary Position

Overview

Temporary Positions are created from transactions originating from other modules such as leave management.

Navigation

Human Resources ►Employee Management ► Assignment Management ► Temporary Position

The screen Temporary Positions includes the following fields:

| Field | Definition |

| ID | Unique identification code. |

| Active | If checked, Temporary Position is active. |

| Employee | Unique identification code of the Employee. |

| Employee Assignment | Employee Assignment associated to the Temporary Position. |

Salary Transition

Overview

Salary transitions give the salary history of an employee. An assignment must have a minimum of one salary transition in his or her file. A user can have many salary transitions.

Navigation

The Salary Transition screen includes the following fields:

| Report Fields | Fields |

| ID | Automatically generated ID |

| Workflow Status | State of salary transition can be either: Approval Requested, Approved, Cancelled, Created and Rejected. |

| Employee | The employee who's salary is being transitioned. |

| Employee Assignment | Assignment assigned to an employee. |

| Is OffScale | Check box if salary amount is outside of the salary scale. |

| Transition Date | Date of salary transition or the date when salary changes takes place. |

| Salary State | State of salary can be either: CREATED,APPROVAL REQUESTED, APPROVED, REJECTED, and CANCELLED. |

| Group | Salary group. |

| Classification | This will give the subgroup, group level for a certain effective date. |

| Salary Step | The salary amount of the salary table |

| Amount | This is the amount of the salary when it is outside of the salary scale (off scale) |

| Language | Language used. |

| State Note | Note justifying actions such as rejected and canceled. |

Terminate Institution

Overview

An Institution entity contains the information of every Institution Unit that plays a role in the system.

Navigation

Human Resources ► Employee Management ► Assignment Management ► Terminate Institution

| Fields | Definitions |

| Code | Unique alphanumeric code manually entered or automatically assigned by the system according to the General Parameter Generate Institution ID (see Parameters > Base Entities > Id Generation). |

| Institution Code | Unique alphanumeric code manually entered. |

| Active | If false, the Institution cannot be used anymore and it would be there for reference purposes. |

| Is Requestor | Can be selected when issuing Purchase Transactions. |

| Is Budget Office | Can be used in all budget transactions/processes (budget preparation, transfers, obligations, commitments, etc.). |

| Is Collection Agency | Collection Agency that will be selected automatically when issuing: Debit Notes, Cash Receipts, Sales Voucher |

| Is Accounting Office | Can be selected when issuing: EV, JV, Cash Sales, Cash Receipts, Debit/Credit Notes, Sales Vouchers, Sales Invoices, PO, PR. |

| Is Purchasing Office | Can be selected when issuing Purchase Transactions (PR, PO, etc.) |

| Is Asset Responsible | This Institution can be selected in Asset Transactions. |

| Is Receiving Location | Can be selected when issuing Purchase Transactions (PR, PO, etc.) |

| Can be Office to be Invoiced | Can be selected when issuing: Cash Receipts, Cash Sales. |

| Is Inspection Location | Can be selected when issuing Purchase Transactions (PR, PO, etc.) |

| Is Contract Issue Office | Can be selected when issuing Purchase Transactions (PR, PO, etc.) |

| Is Inventory Responsible | This Institution can be selected in Inventory Transactions. |

| Is Organization Unit | Only users from the HR system can manage this attribute. When the Organization Chart is needed, the system will display only the instances that has this attribute as true. |

| Is Asset Warehouse | If User switches it to True, then this Institution will also be used as Warehouse to store Asset Items. |

| Is Inventory Warehouse | User switches it to True, then this Institution will also be used as Warehouse to store Catalogue Items. |

| Start Date | Date when the Institution starts or started. |

| End Date | Date when the Institution ends or ended. |

| Coding Block | This entity has the information of every coding block with the structure (number of elements and order of concepts) of the Group. This entry is optional. If not entered, the default code is used from Cost Items or Automatic Cost Items. If there is no Cost Items coding, it will come from Employee Assignment. |

| Default Offset Code | Code that will be defaulted when this Institution is issuing: EV, Cash Sale, Sales Invoice, Debit/Credit Notes, Sales Voucher. |

| Default Bank Account | Bank Account that will be defaulted when this Institution is issuing: EV, Cash Sale, Sales Invoice, Sales Voucher |

| Default Payment Location | Payment location that will be defaulted when this Institution is issuing: EV, Cash Sale, Sales Invoice, Debit/Credit Notes, Sales Voucher, Journal Voucher |

| Default Payment Mode | Payment Mode that will be defaulted when this Institution is issuing: EV, Cash Sale, Sales Invoice, Debit/Credit Notes, Sales Voucher, Journal Voucher. |

| Level in Hierarchy | This field is automatically generated and is for viewing purposes. |

Accumulated Benefit Summary

Overview

Employees earn benefits such as vacation, overtime and other allowances during the year. These are calculated in each payroll calculation. The Accumulated Benefit Summary screen displays the balance of each distinct benefit that the employee has, as well as how much they have used thus far for the fiscal year.

Navigation

Human Resources ► Employee Management ► Assignment Management ►Accumulated Benefit Summary

The Accumulated Benefit Summary screen includes the following fields

| Field | Definition |

| Employee | Employee field - use for search purposes. |

| Assignment | Assignment field - use for search purposes. |

| Fiscal Year | Financial year. |

| Accumulated Benefit | Accumulated Benefit field - use for search purposes. |

| Balance | Calculated balance value from Cost Item per Period used during payroll calculation. This is the available balance. |

| Accumulated | Accumulated value from Cost Item per Period if "Accumulated" is selected as "Effect on Accumulated Benefit" under Cost Item. This represents the credits that were given to the employee during the year. |

| Credit | Credit value from Cost Item per Period if "Credit" is selected as "Effect on Accumulated Benefit" under Cost Item. This represents the credits that were given to the employee during the year. |

| Debit | Debit value from Cost Item per Period if "Debit" is selected as "Effect on Accumulated Benefit" under Cost Item. This represents the debit transactions that were given during the year. |

| Paid | Paid value from Cost Item per Period if "Paid" is selected as "Effect on Accumulated Benefit" under Cost Item. This represents the amounts that were paid from this accumulated benefit. |

| Taken | Taken value from Cost Item per Period if "Taken" is selected as "Effect on Accumulated Benefit" under Cost Item. This represents any time that was taken for this accumulated benefit during the discal year. |

| Initial Entitlement | Initial Entitlement from Cost Item per Period for Entitlement selected as "Transaction Type". |

Employee Assignment Allow Multiple Institution

Overview

This entity defines a dummy screen based on the Institution Entity which the main purpose is to update the boolean attribute Allow Multiple Assignments propagating to its children.

Navigation

Human Resources ► Employee Management ► Assignment Management ► Employee Assignment Allow Multiple Institution Tree

Employee Assignment Allow Multiple Institution screen fields

| Fields | Description |

| Institution | This field used to indicate the Institution to be updated. |

| Allow Multiple Assignments | The users must indicate the value to be updated as boolean. |

| Propagate to Children | This field used to allow to propagate to children the value defined in the attribute Allow Multiple Assignments. |