Automatic Deductions

Overview

Most deductions are established in advance for multiple pay periods. When an employee's pay is calculated, all deductions must be determined before finalizing the pay. Automatic deductions are standardized and accumulate automatically when the payroll is calculated. Automatic deductions are those identified with an assignment, which apply to every pay period in which the employee is included. This screen allows automatic deductions to be linked to individual employees and the specific assignment they apply to. The automatic deductions defined on this screen also appear in the Employee Assignment once approved. The specifications of these deductions are generated on each scheduled pay period automatically.

A screenshot of the Automatic Deductions feature is available here. Image shown as reference material; position and names for labels, fields and buttons are subject to parameter, rendering control configuration and installed revision.

Users access Automatic Deductions from within the menu through this navigation path:Payroll Management ► Employee Payroll Settings ► Automatic Deductions

Visible Fields

The following table lists and describes all visible fields for the Automatic Deductions feature, in their default order. Note that some fields depend on System Parameters and rendering control configuration to be visible and/or editable by users. Field names are subject to change through language label configuration.

Field | Description |

|---|---|

Employee | Employee code. |

Employee Assignment | Assignment ID retrieved from the employee assignment screen. Available only in search mode. |

Deduction | Deduction code assigned to the employee. |

Deduction Start Date | Start date of automatic deduction. |

Deduction End Date | End date of automatic deduction. |

| Reference Number | This field is used to maintain external account numbers e.g. loan numbers. |

Automatic Deduction Updater | This gets updated by the system depending on the process that created the record. |

Vendor | This can be left empty but users can only pick one vendor only. |

Is In Arrears | If checked, the deduction is deferred. |

Amount | A deduction amount that is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Rate | Percentage rate of deduction that is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Exemption | Exemption amount before this deduction is to be applied. This value is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Minimum Salary | Minimum salary for this deduction to be applied to. This value is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Financial Coding Block Debit | Debit financial coding block. This entry is optional. If not entered, the default coding is used from deductions or automatic deductions. If there are no deductions coding, it comes from employee assignment. |

Financial Coding Block Credit | Credit financial coding block. This entry is optional. If not entered, the default coding is used from deductions or automatic deductions. If there is no deductions coding, it comes from employee assignment. |

Max Cumulative Deduction | The maximum cumulative deductions are specific to the automatic deduction and can be entered to control the value of this deduction. Plus the cumulative amount paid to date would also be displayed. When the maximum amount has been reached, the system automatically ends the automatic deduction. |

Explanation | Detailed description as to why the automatic deductions was customized. |

| Language | Language used to enter explanation. |

Attachment Tab | Using this tab, users attach one or more files related to the expense voucher. File types allowed are specified in system parameters. |

| Automatic Deduction Cost Item Tab | Using this tab, users store automatic deduction cost item related to the automatic deduction. |

| Button Image | Description |

|---|---|

| The New button allows users to switch to insert mode. This action button allows users to manually create expense vouchers. |

| The Search button allows users to switch to search mode. |

| The Workflow History button displays a summary table of the executed workflow transitions for the selected expense voucher. |

| Calendar date-pickers allows users to select on a visual calendar a specific date. Within Expense Voucher, it is used to select the voucher date, invoice date and invoice receipt date. |

| The New button allows users to add details to the selected tab. It is used to add expense voucher line items, expense voucher payment details and attachments. |

| The Transition button allows users to execute the selected workflow status change. When selected, users are prompt with a window to log any relevant information about the status change. | |

| The Generate Data Import Template button allows users to generate the import template. |

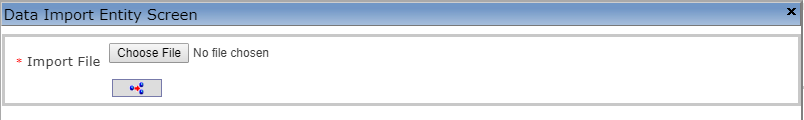

| The Execute Date Import button allows users to import a file from outside the GRP. When clicking the icon, a screen appears:

|

Attachment Tab

Overview

Attachment tab allows users to attach files for supporting the automatic deduction.

Visible Fields

Field | Description |

Id | Unique identification code for the transaction, this field’s value is assigned by the system or provided by users depending on System Parameters. |

Title | Name of the attachment. |

Description | Detailed description of the attachment. |

Attachment Classification | Reference to attachment classification. |

| Attachment | Button for navigating the file and attach to the screen. |

Date Time | Date and time of the last operation performed on the attachment document, automatically generated upon saving the Attachment. |

| Date | This attribute classifies the attribute in terms of date and used as a reference for Reports and Forms. |

| Language | Language used to enter title and description. |

User | The user who added the attachment, automatically generated by the system. |