Financial Disclosure

Agreement Type

Overview

Contains the information related with the agreement types used for revenues and assets (e.g. Contract of sale, Gift agreement, Rent agreement, Payment service, etc).

Navigation

Human Resources ► Support Entities ► Financial Disclosure ► Agreement Types

Agreement Type screen fields

| Fields | Description |

| Code | Unique identifier for type of agreement, manually entered by users. |

| Active | Default value true, if value is changed to false it can’t be selected again and record remains for reference purposes only. |

| Used By Movable Assets | Default value false, flag to define if the agreement type is used by movable assets. |

| Used By Immovable Assets | Default value false. Flag to define if the agreement type is by immovable assets |

| Used By Revenues | Default value false. Flag to define if the agreement type is used by revenues |

| Agreement Number Mandatory | Default value false. Flag that used to validate the Number of Agreement as a mandatory field in the Revenues section of the Declaration Form. When attribute 'Is Used by Revenues' is FALSE, this field is not visible. |

| Agreement Issue Date Mandatory | Default value false. Flag used to validate the Agreement Date of Issue as a mandatory field in the Revenues section of the Declaration Form. Attribute is not visible when 'Is Used by Revenues' is FALSE. |

| Language | Select language to register the name and description. |

| Name | Contains the name of the Agreement Type. |

| Description | Contains the full description of the Agreement Type. |

Declaration Schedule

Overview

This feature contains the information related with the declaration years and validation date types used for all the declaration status defining a start and end date (e.g. create declaration allowed between January 1st and March 31 of current year, analysis declaration allowed between April 1st and September 30th). Also defining which declaration year is the current to be used by the system.

Users access Declaration Schedule from within the menu through this navigation path: Human Resources ► Support Entities ► Financial Disclosure ► Declaration Schedules

A screenshot of the Declaration Schedule feature is available here.

Image shown as reference material; position and names for labels, fields and buttons are subject to parameter, rendering control configuration and installed revision.

Visible Fields

| Fields | Description |

| Id | Unique identifier for Declaration Schedule, automatically assigned by the system. |

| Current Schedule | It is a flag that identifies if the current declaration year record is the current one. Default value for this field is false. |

| Schedule Start Date | Allows to enter start date of Schedule as initial period for declaration year. |

| Schedule End Date | Allows to enter end date of schedule as final period for declaration year, the date must be later or equal to schedule start date. |

| Exception on Start Date | Allows to enter the exception on the start date of schedule as initial period for declaration year. |

| Exception on Appointment Date | Allows to enter an exception date on appointment, the date must be between schedule start date and end date. |

| Exception on Dismissal Date | Allows to enter an exception date on dismissal, the date must be between schedule start date and end date. |

| Months for Submission | Allows to enter the number of months after the schedule start date when the declaration needs to be submitted. |

| Exception For Submission In Days | Allows to enter the exception on the number of months after the date of appointment or date of dismissal when the declaration needs to be submitted. |

| Start Date To Modify | Allows to enter the start date to modify a declaration, the date must be a later date than schedule end date. |

| End Date To Modify | Allows to enter the end date to modify a declaration, the date must be between schedile end date and start date to modify. |

| Based on Legislation Number | Allows to enter the legislation number on which the declaration schedule is based. |

| Language | Allow users to select language to register name and description. |

| Name | Allows to enter a short name of the declaration dchedule. |

| Description | Allows to enter a detail description of the declaration dchedule. |

Buttons

| Button Image | Description |

| The New button allows users to switch to insert mode. This action button allows users to manually create Declaration Schedule. |

| The Search button allows users to switch to search mode. |

| Once an entity has been created or searched for, users may view results when necessary. |

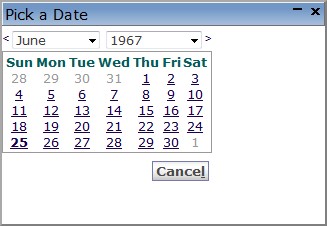

| Allows to select a calendar date. The following window appears:

|

| Click to Save a created record. The record is then added and a window appears to notify the record has been saved. |

Financial Commitment Type

Overview

Contains the information related with the type of financial commitments that civil servants declare (e.g. demand loan, target loan, loan, goods loan, mortgage lending, commercial credit, lending).

Navigation

Human Resources ► Support Entities ► Financial Disclosure ► Financial Commitment Types

Financial Commitment Type screen fields

| Fields | Description |

| Code | Unique identifier for type of financial commitment, manually entered by the user |

| Active | Default value true. If this value is changed to false, it can’t be selected again and record remains for reference purposes only |

| Language | Select language to register the details |

| Name | Contains the name of the Financial Commitment Type |

| Description | Contains the full description of the Financial Commitment Type |

Owned Immovable Asset Type

Overview

Owned Immovable Asset Type contains the information related with the type of assets (immovable) that civil servants should declare as owners (e.g. house, apartment, villa, land, garage; building, block, workplace).

Navigation

Human Resources ► Support Entities ► Financial Disclosure ► Owned Immovable Asset Type

Owned Immovable Asset Type screen fields

| Fields | Descriptions |

| Code | The unique identification code for the type of asset to be manually entered by users. |

| Active | Active refers that the record s available for use. If this value is changed to false, it can’t be selected again and it will remain for reference purposes only. |

| Area Mandatory | This field validates whether the Area is a mandatory field in the Immovable Assets section of the Declaration Form. The default value is false. |

| Registry Nbr Mandatory | This field validates whether Registry number is the mandatory field in the Immovable Assets section of the Declaration Form. The default value is False. |

| Share In Property Mandatory | This field validates whether Share in Property is a mandatory field in the Immovable Assets Information of the Declaration Form. The default value is false. |

| Show In Share Capital Asset Information | This field used to show the record on the Share Capital Assets Information from the Declaration Form. The default value is False. |

| Is Trust Manager | This field defines the use of the record as Trust Manager (TRUE) on the Share Capital Assets Information from the Declaration Form. |

| Is Share Capital | It defines the use of the record as Share Capital (TRUE) on the Share Capital Assets Information from the Declaration Form. |

| Language | The country-specific language used for description to be selected from the dropdown box. |

| Name | This field contains the name of the Asset. |

| Description | This field allows the user to write full description of the Asset. |

Owned Movable Asset Type

Overview

Owned Movable Asset Type contains the information related with the type of movable asset that civil servants should declare as owners (e.g. forests, perennial plantings, automobiles light, trucks, agricultural equipment, and furniture).

Navigation

Human Resources ► Support Entities ► Financial Disclosure ► Owned Movable Asset Type

Owned Movable Asset Type screen fields

| Fields | Descriptions |

| Code | The unique identification code for the type of asset to be manually entered by users. |

| Active | Active refers that the record s available for use. If this value is changed to false, it can’t be selected again and it will remain for reference purposes only. |

| Vehicle Serial Nbr Mandatory | This field validates whether the Property Registry Number is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Brand Mandatory | This field validates whether the Brand is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Model Mandatory | This field validates whether the field Model is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Year Mandatory | This field validates whether Year is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Volume Mandatory | This field validates whether Volume is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Location Mandatory | This field validates whether the Location is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Legal Entity Name Mandatory | This field validates whether Legal Entity Name is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Nbr. Livestock Mandatory | This field validates whether Number Livestock is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Nbr. Crop Mandatory | This field validates whether Number Crop is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false |

| Nbr. Shares Mandatory | This field validates whether Number Shares is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Nbr. Precious Metal Bullion Mandatory | This field validates whether Number Precious Metal Bullion is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Nbr. Precious Metal Items and Antiquities Mandatory | This field validates whether Number Precious Metal Items and Antiquities is a mandatory field in the Movable Assets Information of the Declaration Form. The default value is false. |

| Show In Share Capital Asset Information | This field validates whether to show Share Capital Asset Information in Declaration Form. The default value is false. |

| Language | The country-specific language used for description to be selected from the dropdown box. |

| Name | Contains the name of the Asset. |

| Description | Contains the full description of the Asset. |

Relative Relation Degree

Overview

It contains the information related with the kind of relatives relation degree, whom have financial dependencies from civil servants and should declare (e.g. Spouse, Children (under 18), Parents, Brother or Sister).

Navigation

Human Resources ► Support Entities ► Financial Disclosure ► Relative Relation Degree

Relative Relation Degree Screen Fields

| Fields | Descriptions |

| Code | Unique identifier for relation degree and it will be manually entered by the user. |

| Active | Default value true. If this value is changed to false, It can’t be selected again and it will remain for reference purposes only. |

| Language | The country specific language user can select from the drop-down list. The Default language is English. |

| Name | Contains the name of the Relation Degree. |

| Description | Contains the full description of the Relation Degree. |

Revenue Type

Overview

The type of revenues that civil servants should declare is registered through Revenue Types (e.g. revenues from working place; from competitions, awards, lotteries, gambling; from capital assets and shares in commercial companies; as gifts; as inheritance; from business activity).

Navigation

Human Resources ► Support Entities ► Financial Disclosure ► Revenue Type

Revenue Type Screen Fields

| Fields | Description |

| Code | Unique identifier for type of revenue manually entered or automatically generated depending on the system parameters |

| Active | Default value true. If value is changed to False (unchecked), it can’t be selected again and it will remain for reference purposes only. |

| Source Mandatory | Default value false. If value is changed to True (checked) than the Source of Revenue will become a mandatory field in the Revenues section of the Declaration Form. |

| Agreement Type Mandatory | Default value false. If value is changed to True (checked) than the Type of Agreement will become a mandatory field in the Revenues section of the Declaration Form. |

| Name | Contains the name of the Revenue Type. |

| Description | Contains the full description of the Revenue Type |