Payroll Management

The Payroll Management module is a key component within the Civil Service Management core. It enables governments to process the entire government's payroll using sophisticated algorithms. These algorithms address in totality the wide variety of payroll situations and scenarios.

It utilizes common data from the GRP's CSM and Financial core. Users need only to enter information once within another CSM or Financial module, for Payroll to leverage that information.

Payroll Management provides key operational and managerial reports needed for ensuring transparency and immediate accountability.

The server side calculation engine can process hundreds of thousands of payroll records, in a batch process manner, within a single day at a high performance level. Complex payment management needs utilized, such as Pay Agents, direct cash, grouped payments and such, are supported by default via configuration.

Due to the nature and sensitivity of payroll, the system provides for key notifications to the authorized user who initiated the payroll calculation. These key notifications occur during and after the payroll engine is running and provide for appropriate monitoring by the government over the payroll process.

Support Entities

Cost Item Management

Cost Item

Overview

A cost item is any element that can be used to predict and calculate future developments of organizational departments such as basic salary, vacation pay and full-time salaries at the assignment level. There are four information tabs at the bottom that further expand the capabilities of a cost item. The deductions tab lists the deduction and cost item relationship for a deduction calculation. A deduction can be viewed, added or deleted in this tab. The dependant tab represents cost items calculated on other cost items. For example, another expense can appear from producing an employee's salary. Each cost item, by law, may be associated with an income tax which will be recorded in the Income Tax tab within the Cost Item function. The last tab is Effective Date which manages all the different dates that document when the cost item will become effective. This screen performs many functions that are key to the payroll management.

Navigation

Payroll Management ► Support Entities ► Cost Item Management ► Cost Item

Cost Item screen Fields and Tabs

Field | Description |

Code | ID for the Cost Item. It is a user given field. |

Is Basic Salary | If checked, Cost Item is a Basic Salary earning. |

| Is Allowance | This Boolean is used when the keyword 'sumallowance' is used in the Reduction Deduction entity. |

| Is Retroactive | This Boolean is used when the keyword 'sumallowance' is used in the Reduction Deduction entity. |

Is ProRated | If checked, Cost Item will be ProRated. A ProRated Cost Item will be used mainly for a salary increase in the middle of a pay period or if an employee resigns in the middle of the month. |

Is Limiting Regular | This is the reduction amount of a cost item in association with a specified effective date. |

Allow in Module | When set to "Time and Attendance", this cost item will be available in Time and Attendance, while if set to "Leave", the cost item will be used by the Leave Module. Default is "Not Applicable". |

Is Task Mandatory | If selected, the Task will be mandatory when entering Time and Attendance. |

Is Overtime | If checked, Overtime can be entered in Time and Attendance. |

Is Leave | False by default. If true, Leave can be added under Time and Attendance. |

Is Cumulating Hours | If checked, a Cost Item will Accumulate Hours which will be recorded with the Cumulated Hours menu. This will then be used for Records of Employment. |

Is Conversion Needed | If checked, Conversion will be used when worked hours and paid hours in Time Schedule are different. Refer to Payroll Calculation for details. |

Are Hours Insurable | If checked, hours are counted on record of employment. |

Allows Frequency Change | If selected, the Frequency can be modified in Time and Attendance. |

Is Non Salary Scale | When Frequency is DAILY or HOURLY, Non Salary Scale can not be selected. When Frequency is NOT DAILY or HOURLY, Non Salary Scale can be selected. If selected, extra fields in Cost Items will be mandatory to complete in order to specify which scale to use. |

| Has Effect On Pay | Indicates if the cost item affects the pay. |

Is Printed On Pay Stub | By default - will be selected as Cost Items that have an effect on the pay should be printed on the pay slip. If not selected, Cost Item will not be printed on pay slip - when the cost item is for cumulative benefits for example. |

Is Statutory Holiday | Will be checked if Cost Item is a Statutory Holiday and will be used as a pay calculation. When selected, Is Limiting Regular will be selected and cannot be unselected. Frequency will display DAILY when Is Statutory Holiday is selected. |

Calculate Length Of Service | If selected, the Cost Item will be used to calculate length of service. |

| Is Compensation Based On Employees File | Default is False. If it is true then compension is based on Employee’s File. |

| Is Retroactive Pay Period Mandatory In CIPP | Default is False. If it is true then Retroactive pay period mandatory in Cost Item per Period. |

| Allow only once by Employee despite Multiple Assignments | Default Value is FALSE. |

Inactive Date | By default, is null. Once a date is entered the Cost Item will no longer be available on and after that date. |

Frequency | Use of Cost Item - Daily, Hourly etc. |

| Frequency based on | Frequency based- Calander days, Working day etc. |

Accumulated Benefit | Accumulated benefit can be measured as daily, hourly, or monetary. It is identified by a 10 digits. |

Type | Select from the Drop Down Menu the Type of Cost Item that users are creating. |

| Cost Item type for reports | Default Null. BONUS, SENIORITY, SOLIDARY BONUS, ZONING, TEACHING. |

Sequence | This will decide the order these Cost Items will be calculated. |

Maximum value by calculation | It allows setting the maximum value for the cost calculation. |

| Income Code | Official Code that will be used to print on tax forms in Canada. |

Should pay excess value | If checked then allows paying the excess value for the cost item. |

| Is Allow More Than Once Same Cost Item | Default Value is FALSE. If this value is true, system will allow same Cost Item code in Automatic Cost Item within same Employee Assignment |

| Legacy Reference | Defines the Legacy Reference associated with the Cost Item. |

Debit Coding Block | It's not mandatory to assign the whole coding block to a Cost Item - part of the segments can be used. Refer to Coding Block for more information. |

| Credit Coding Block | Defines the Legacy Reference associated with the Cost Item. |

| Cost Item Payment Frequency | Cost Item Payment Frequency. Daily, Monthly, Yearly etc. |

Tax Cap Summary | Allows adding Tax cap Summary. |

| Retroactive Payment Cost Item | When TRUE, in CIPP the field Retroactive pay period is mandatory. |

Name | Cost Item Name. |

Description | Cost Item Description. |

Pay Stub Text | This will appear at the bottom of the pay stub. |

Deduction Tab | A deduction can be associated to deduct from the earning this cost item incurs. |

Dependant Tab | Any cost item that is required to be present in order for this cost item to be calculated. This will specify the relationship between the two. |

Income Tax Tab | Information to the Income Tax will be selected here if necessary. |

Effective Rates Tab | The calculation specifics will be identified under this tab. The Cost Item can be based on percentage rates, or specific amounts. |

| Compensation Definition Tab | A collection of zero to many Compensation Definitions |

| Individual Strategy Aggregated Cost Items Tab | This collection will be used during payroll tax calculation. |

Institution | Allows selecting Institution for the Cost Item. |

Compensation Definition

Overview

This Entity defines the amount for a Compensation Definition.

Compensation Definition Tab Screen Fields

| Fields | Description |

| Compensation | Defines the compensation to be used |

| Amount | Defines the amount of compensation |

| Calculation Strategy | This attribute could take one of the following values: 'Amount', 'Percentage'. |

Cost Item Deduction Tab

Overview

A Deduction can be associated to deduct the cost from the cost item.

Deduction Tab screen Fields

| Field | Description |

| Active | If checked, the deduction will be active (applicable during calculation). |

| Cost Item Deduction | The predefined deduction to be used. |

| Cost Item Rate | The percentage amount of the cost item that the deduction will apply to. Range from 0 – 100. |

Dependant Tab

Overview

Any cost item that is required to be present in order for this cost item to be calculated. This will specify the relationship between the two.

Dependant Tab screen Fields

Field | Description |

Active | If checked, the dependant is active (applicable during calculation). |

Considered Cost Item | The Cost Item that will be used as the dependant. |

Rate | The percentage amount of the cost item that the deduction will apply to. Range from 0 – 100. |

Find Last Amount Paid | False by default When TRUE, during payroll calculation, the system needs to go and find the last amount paid to this employee. |

| Find Last Amount Paid Range Dates | Default = FALSE, When TRUE, the system must find only other cost items per period with status Finalized and Start Date and End Date are between the current pay period Start and end Date. |

Dependant Formula | This will allow to define a formula. We need to be able to multiply,divide,add,substract from the value of this cost item. |

Value Based on Avg of Last Pay Periods | Refers the average value which was applied for last pay periods. |

Is Average Based on Actual Working Days | If checked then it allows the average to be applied based on actual working days. |

Effective Rates Tab

Overview

The calculation specifics will be identified under this tab. The Cost Item can be based on percentage rates, or specific amounts.

Effective Rate Tab screen Fields

Field | Description |

Cost Item Effective Dates | The date at which the cost item becomes effective. |

Amount for Frequency | The amount of the cost item. |

Rate | The percentage of the amount to be calculated for the cost item. |

Income Tax Tab

Overview

The Income Tax Tab contains the information of any taxes that apply to the cost item.

Income Tax Tab screen Fields

Field | Description |

Income Tax Destination | The Income Tax Destination that applies to the Income Tax for this cost item. |

Income Tax Type | The Income Tax Type that applies to the Income Tax for this cost item. |

Rate | The percentage amount of the cost item that the deduction will apply to. Range from 0 – 100. |

Is One Time Benefit | If checked, the tax will be linked to the benefits function. |

| Minimum taxable amount | The amount specified here will determine if the cost item gets taxed or not. |

| Exemption amount | This is where you specify the amount to be removed from the cost item amount. |

Cost Item Per Period Reason

Overview

This screen enables the ability to include a detailed description towards any Cost Items that are added or modified in a certain pay period. A name and detailed explanation can be included towards the association of a cost item to a specific period chosen. A Cost Item can also be functional or non-functional during its specified period by the checking or un-checking the Active checkbox.

Cost items per Period Reasons can be associated with a given cost item. This information can be predefined in order to ensure there is a valid reason to distribute the cost item selected. This screen provides detailed descriptions of acceptable reasons that can be allocated to cost items given on a per period basis.

Navigation

Payroll Management ► Support Entities ► Cost Item Management ► Cost Item Per Period Reason

Cost Item Per Period Reason screen Fields

Field | Description |

Code | ID for the Cost Item Per Period Reason. It is a system generated code. |

Active | If checked, the Cost Item Per Period Reason is available. |

Name | Description of the Cost Item Per Period Reason. |

Description | Detailed description of the Cost Item Per Period Reason. |

Task

Overview

This screen provides a list of tasks that could be assigned to an employee. A task function describes what will be the relationship between the cost item and the assignment. This is usually represented by what position or role an employee will be given.

Navigation

Payroll Management ► Support Entities ► Cost Item Management ► Task

Task screen Fields

Field | Description |

ID | ID for the Task. It is a system generated code. |

Active | If checked, the Task is available. |

Amount | Amount that will override the salary scale. If nothing is entered here, then the default employee’s salary scale will be taken into account. |

Frequency | Task is done either Hourly or Daily. |

Coding Block | Financial Coding Block Credit and Debit from entity Cost Items. |

Name | Description of the Task. |

Description | Detailed description of the Task. |

Tax Cap Summary

Overview

A tax cap places an upper bound on the amount of government tax a person might be required to pay. In this case the tax is said to be capped.

Navigation

Payroll Management ► Support Entities ► Cost Item Management ► Tax Cap Summary

Tax Cap Summary screen Fields

Field | Description |

Code | ID for the Tax Cap Summary. It is a system generated code. |

Description | Detailed description of the Tax cap Summary. |

Tax Cap Effective Date Tab | This tab shows the applicable date of the Tax Cap. |

Tax Cap Effective Dates

Overview

This Tab shows the application date of the tax cap.

Tax Cap Effective Date screen Fields and Tab

| Field | Description |

| Effective Date | This effective date indicates when the tax cap ranges will take effect. |

Tax Cap Ranges

Overview

This tab shows the amount limit of the tax cap.

Tax Cap Ranges screen Fields

Field | Description |

Minimum Amount | The minimum amount of the Tax Cap to be defined for the amount range. |

Maximum Amount | The maximum amount of the Tax Cap to be defined for the amount range. |

Fixed Amount | The fixed amount of the Tax Cap to be defined for the amount range. |

Compensation

Overview

This Entity describes all the Compensations based on the Employee's File that will be used by the Cost Item in order to provide a Compensation Definition.

Navigation

Payroll Management ► Support Entities ► Cost Item Management ► Compensation

Compensation Screen Fields

| Fields | Description |

| Code | Code manually entered by the user, if parameter autogenerated id is FALSE. |

| Name | Defines the Name of the Publication |

| Compensation Type | This attribute could take one of the following values: 'Employee Education' 'Relatives Details' 'Trainings' 'Teaching' 'Acknowledgements' 'Publications' 'Ranks and Denominations' The default value is 'Employee Education' |

| Active | TRUE by Default, when FALSE it is no longer active |

Cost Item Payment Frequency

Overview

Pay frequency means the amount of time between employee pay days. Common pay frequencies include: monthly, semi-monthly (twice each month), bi-weekly (every other week), weekly, and daily. This entity is used to indicate how often a Cost item payment is made.

Navigation

Payroll Management ► Support Entities ► Cost Item Management ► Cost Item Payment Frequency

Cost Item Payment Frequency Screen Fields

| Fields | Description |

| Code | ID for the Cost Item Payment Frequency. It is a system generated code or Manual. |

| Payment Frequency | Close domain field. Values are daily, monthly, quarterly, Anualy etc. |

| Are Paid on same periods for all | If it True cost item paid on same periods for all. If it is true then Is Based on Hire Date must be false. |

| Is Based on Hire Date | If it true the cost item paid on the employee Hire date. |

| Cost Item Payment Frequency Periods Tab | This tab defines the pay code and the pay period. When Are Paid on same periods for all check box is true then this tab is visible. |

Cost Item Payment Frequency Periods Tab

Cost Item Payment Frequency Periods screen Fields

| Fields | Description |

| Pay Code | Pay Code of the Employee payroll. |

| Pay Period | The Pay Period on this screen defines the exact dates and ranges of each pay. |

Tax Exemption Codes

Overview

| Fields | Description |

| Code | Manually entered by the user |

| Description | Short Description of tax exemption codes |

| Is this for Non-Residents only | Default= False |

| Active | Default = TRUE |

Deduction Management

Overview

This section deals with the Deductions that are applied to an employee’s earnings. There can be many types of Deductions that must be taken into account when processing an employee’s pay. Deduction Management consists of actions that serve to attribute one or multiple deductions to an employee for specified periods of time. Deductions can be created by Payroll Management and assigned to an employee through the screen 'Automatic Deductions Screen' or 'Deductions Per Period'.

Benefits

Deductions Management establishes a deductions database that serves for organizational processes. This allows upper management to conduct monitoring and analysis of all earnings that have any type of deduction coded in this section. Third party payments, such as Provincial and Federal Income Tax, can be processed more effectively and in a timelier manner with this database that monitors all deductions activity. The payments can be delivered with a higher degree of confidence that can help guarantee compliance to the payment schedule.

Workflow

The Deductions screen stores all deductions within an organization by code. The user can type a deduction code in the appropriate field and then the Deduction function will display all available details regarding that particular deduction. The screen also allows the user to search deductions with a linked cost item, which is displayed at the bottom of the screen. Refer to Deduction for more information.

The Income Tax Destination screen deals with the location each income tax deducted off an employee's earnings will be transferred to. This function ensures that third parties are paid on time on a regular schedule.

The Income Tax Type function is available for the user to view all the different income taxes that could be applied to payroll calculations. Management can select certain income tax types that are only applicable to certain employee earnings and assignments. All income tax types are coded for ease of access so they can be searched and modified without difficulty. Refer to Income Tax Type for more details.

The Pension Fund function deals with pension fund types available to employees. Each pension fund will have unique specifications which can be viewed in the Pension Fund screen. Pension Funds play a very important part in payroll management. Pension funds provide financial security for employees when they retire, that is why deductions from employee earnings must be managed effectively. Refer to Pension Fund for more details.

Deductions

Overview

Deductions are another key factor part of the Payroll Management Section. It reduces the total gross amount computed in employee earnings applicable in a given pay period. Earning codes can be searched, added, modified and deleted in this function. Each deduction can contain many details pertaining to calculation methods, activity status, minimum and maximum deduction amounts, pension administration etc. The earnings minus deductions defined for an employee gives payroll management the net pay to be applied. As earnings and pay are affected by Deductions, this function is another calculation aspect that directly relates to cost items mentioned in the Cost Item Management section. A separate section in this function deals with the cost item and deduction relationship for deduction calculations.

Navigation

Payroll Management ► Support Entities ► Deduction Management ► Deductions

Deductions screen Fields and Tabs

Field | Description |

Code | ID for the Deduction. It is a system generated code. |

Active | By Default, is checked and indicates that Deduction has been previously used in Payroll Calculations. Active can be unchecked so that it is not taken into account in future. |

Employer Share | Indicates if Deduction is an employer Deduction. |

Effect on pay | By Default - is checked. Indicates if the deduction affects the pay. Normally, employer's deductions do not affect the pay. |

Printed on Pay Stub | If checked, deduction will be printed on pay slip. |

Apply Penalties | If checked, a Penalty will be applied affecting Deductions. |

Allow Arrears | If checked, Arrears will be applied to Deductions. |

Reduce Arrears | By Default - unchecked. Select box if required. See Arrears for more details. |

Cost Item Coding Block | If checked, the Coding Block distribution for specified Deduction will be considered on Cost Items. |

Deduction Coding Block | If checked, the Coding Block distribution for specified Deduction will be considered on other Deductions. |

Mandatory | If checked, Deduction will be mandatory. |

| Allow More Than Once Same Deduction On Same Employee Assignment | Default value is FALSE.If this value is true, system will allow same deduction code in automatic deductions within same Employee Assignment |

| Allow To change Vendor In Automatic Deduction | Default value is FALSE. If this value is TRUE, then system will allow to change default vendor in Automatic Deduction |

| Is Retroactive Pay Period Mandatory In DPP | Default = FALSE. When TRUE, in DPP the field Retroactive pay period is mandatory. |

| Legacy Reference | Defines the Legacy Reference associated with the Deduction. |

Inactive Date | By default, this field is empty. Indicates when Deduction is no longer available. Once Active is checked, Inactive Date will produce current date. |

Calculation Sequence | Calculation sequence to ensure that the calculation is processed in the right order. |

Deduction Tax Type Value | This menu will automatically display Employer Taxable when Employer Share is checked. Deduction Tax Type Value will automatically display Tax Credit and Tax Exemption when Employer Share is not checked. |

| Is Pension | If it is true then this Deduction is used Reduction Deduction entity. |

| Is Retroactive pension | This boolean is used when the keyword 'sumretropension' is used in the formula of Reduction Deduction entity. |

| Is Basic Only Tax | This boolean is used when the keyword 'sumbasiconlytax' is used in the formula of Reduction Deduction entity. |

| Recovery tax code | Official Code that will be used to print on tax forms in Canada. |

Deduction Type | This will specify a specific Type of Deduction for calculation purposes. |

| Deduction type for reports | Default NULL |

Vendor | To define the vendor for Deduction to be slected from the lookup button. |

Based on Deduction | To define the deduction base for Deduction to be slected from the lookup button. |

Minimum Hours | Minimum hours for this deduction to be applied. |

Reduction Tax | Percentage of reduction on taxes. |

Rate | Percentage Rate of Deduction. |

Amount | Deduction Amount. |

Maximum Reduction | Maximum reduction amount. |

Exemption | Exemption amount before this deduction is to be applied. |

Minimum Salary | Minimum salary for this deduction to be applied to. |

Maximum by Pay | Maximum Deduction amount per pay. |

Monthly Maximum Amount | Maximum Deduction allowed per month. |

Annual Maximum Amount | Annual maximum Deduction allowed. |

Maximum Age | The age at which the Deduction should stop. |

Name | Description of the Deduction. |

Description | Detailed description of the deduction. |

Pay Stub Text | Any other additional text, besides the deduction description, that should be printed on the pay stub. |

Explanation | Detailed description of the deduction or any other useful information regarding the use of the deduction. |

Inactive Reason | Explanation on why the deduction is not being used. |

Loan | If checked, Loan amount will be adjusted from employee’s deduction. |

Loan Interest | If checked, Loan Interest amount will be adjusted from employee’s deduction. |

Interest Type | To select the interest type which can be Simple or Compound. |

Financial Coding Block Credit | Financial Coding Block for Credit. This entry is optional. If not entered, the default code is used from Cost Items or Automatic Cost Items. If there is no Cost Items coding, it will come from Employee Assignment. |

Financial Coding Block Debit | Financial Coding Block for Debit. If not entered, the default code is used from Cost Items or Automatic Cost Items. If there is no Cost Items coding, it will come from Employee Assignment. |

Retroactive Payment Deduction | Allows retroactive deductions for payment. |

Deduction Cost Items Tab | It lists the deductions and cost items relationship for deduction calculation. It is available from the cost item form and from the deduction form. |

Reduction Deduction Tab | Uses for reduction any other created Deduction from the current Deduction. |

Institution Tab | Allows selecting the institution for deduction. |

Income Tax Type

Overview

Income taxes are one of the main deductions used towards an employee's earnings. These income taxes that will be used are divided by the different types they fall under. All available income tax types are listed in this function and retrieved on a regular basis when doing payroll calculations. One calculation might specify a certain type of income tax that could be different from other calculations. The user will able to search and retrieve that specific income tax type and view its associated details such as the name and explanation of use. All deduction calculations are processed with a certain income tax type code which is stored in this function.

Navigation

Payroll Management ► Support Entities ► Deduction Management ► Income Tax Type

Income Tax Type screen Fields

Field | Description |

Code | ID for the Income Tax Type. It is a user given code. |

Active | If checked, the Income Tax Type is available. |

Name | Description of the Income Tax Type. |

Description | Detailed description of the Income Tax Type. |

Income Tax Destination

Overview

The income tax destination function organizes all the different types of taxes that can be applied to a cost item. For instance, an employee's earnings will be subject to deductions as discussed in the Deductions function. These deductions can take the form of a Federal tax, Provincial tax, etc. Each type of deduction will have a unique identification code with associated content displaying details such as a name for the deduction and a brief description explaining its intended use. A separate section, called the Income Tax Destination Details, displays even further, in another screen, more details about that specific deduction. Any information regarding the deduction type, amounts and the fiscal year being applied to the deduction can be viewed in this screen. It also allows the ability to enter or change information in these fields if a deduction is being created or modified.

Navigation

Payroll Management ► Support Entities ► Deduction Management ► Income Tax Destination

Income Tax Destination screen Fields and Tab

Field | Description |

Code | ID for the Income Tax Destination. It is a user given code. |

Active | If checked, the Income Tax Destination is available. |

Is Fixed Amount Mandatory | If checked, indicated Fixed Amount is mandatory. |

| Has Mandatory Cost Items | |

Basic Personal Deduction | Basic personal amount which is exempted from tax. |

Frequency | Frequency may be Annual or Pay Period. |

| Taxable Amount Calculation Strategy | Values are: SUM ALL Cost Items, SUM ALL CI regardless of institution, Treat each CI INDIVIDUALLY |

| Forecast Taxable Amounts based on Actual Periods | When it is true it allows user to forcast taxable amounts based on actual periods. |

| Employees with incomplete Fiscal Year are Forecasted on full Fiscal Year | When it is true it allows user to Forecasted on full Fiscal Year |

No of Pay Periods For Fixed Amount | This attribute is needed only when a fixed amount is entered in the income tax destination detail is entered instead of a rate and constant. The number that is entered in here will be used to divide the fixed amount. |

Personal Credit Rate | Rate applicable when calculating tax destination amount. |

Name | Description of the Income Tax Destination. |

| Language | Country specific language used to register the descriptions. |

Description | Detailed description of the Income Tax Destination. |

Income Tax Destination Details Tab | Uses to provide details about Income tax Destination. |

| Cost Item | Collection of 0 to many. |

Income Tax Destination Details Tab

Overview

It defines the Income Tax Destination Details. It has the possibility to define the different ranges.

Income Tax Destination Details Tab screen Fields

Field | Description |

Effective Date | This is the date that the rates become effective. When calculating the tax, the system must find the effective date of the Pay Period. |

Minimum Amount | The minimum amount of the Income Tax Destination. |

Maximum Amount | The maximum amount of the Income Tax Destination. |

Rate | Rate applicable for the calculation of the income tax. Either Rate or Fixed Amount is mandatory. |

Fixed Amount | Fixed amount of the Income Tax. |

Constant | Constant amount of Income Tax if any. |

Income Tax Type | The type of Income Tax. |

Pension Fund

Overview

A pension fund is a function formed by a pool of assets whose purpose is to finance pension plan benefits. These benefits are created by contributions taken from employee earnings. The contributions are a type of deduction managed with cost items. They are normally a standardized percentage that is to be taken from the employee pay and put into one type of pension fund. An organization can have different types of pension funds directed at employees with different types of positions within an organization. This screen lists and organizes the different types of pension funds that will be used when calculating deductions. Each pension fund type is recorded by an ID and provides the name of the pension fund and a description of the fund. A separate section within this function called Pension Fund Details, provides monetary details regarding the pension fund such as minimum and maximum amount of the pension.

Navigation

Payroll Management ► Support Entities ► Deduction Management ► Pension Fund

Pension Fund screen Fields and Tab

Field | Description |

ID | System generated code for the pension Fund. |

Active | If checked, the Pension Fund is available for use. |

Name | Name of the Pension Fund. |

Description | Detail description of the Pension Fund. |

Pension Fund Detail Tab | Stores the information about pension fund details such as amounts and rates. |

Pension Fund Details Tab

Overview

Field | Description |

Minimum Amount | The minimum amount of the Pension Fund. |

Maximum Amount | The maximum amount of the Pension Fund. |

Rate | Rate applicable for the calculation of the Pension Fund. Either Rate or Fixed Amount is mandatory. |

Constant Amount | Constant amount of Pension Fund if any. |

Pay Period Management

Overview

Pay period management allows the user to accommodate to the numerous pay structures and monitor them effectively.

Use the Pay Code function when dealing with the different types of pay and their associated pay periods. Pay Code allows the user to make managerial decision when all required data is available in an organized fashion within one user screen. A new pay code can be created here and existing pay codes can be modified and deleted. This function is a key feature when dealing with payroll management amongst many employees in an organization. Every pay implemented has an assigned code which will then display information about that pay. For example, working hours of the employee, works days per week and other additional information is displayed when a pay code is searched. This information can also be added when creating a new pay code. Refer to Pay Code for more details.

Payment schedules may vary from one employee to the next. Organizations can have numerous pay schedules in which each employee is linked to. In order to accommodate for these schedules, Pay Period Management outlines this information. Once the information on the schedules is defined, the implementation and payment procedure will be carried out more effectively and accurately.

Generate Pay Periods Based on Fiscal Year

Pay Code

Overview

Each employee will have a specified schedule that will outline their pay dates. This selected schedule of pay depends of the pay details associated with the employee’s position and assignment as decided by the organization. The Pay Code screen is used to list and define the details pertaining to each schedule that an employee can belong to. The Pay Code maintains the detailed information such as Name, Description, and Pay Periods for each. The Pay Period is a crucial factor on this screen as it defines the exact dates and ranges of each pay.

Navigation

Payroll Management ► Support Entities ► Pay Period Management ► Pay Period

Pay Code screen Fields and Tab

Field | Description |

Code | A unique identification code for Pay. |

Active | If checked indicates the Pay Code is available. |

Number Of Pay Periods Per Year | Total number of pay periods in the fiscal year. |

Number Of Work Days Per Period | Number of work days in a period e.g. 21 for monthly Pay Period. |

Number Of Weeks Per Year | Number of work weeks in the year. |

Number Of Days Per Year | Number of days in the year. |

Number Of Work Days Per Year | Number of work days in the year e.g. 260 or 261. Used for the payroll calculation. |

Actual Number Of Work Days Per Year | Actual number of working days in the year. |

Average Work Days Per Year | Average number of working days per year (e.g. 260.88) to be entered by the user. Used for forecasting. |

Average Work Days Per Month | Average number of working days per month (e.g. 21.00) to be entered by the user. Used for payroll and forecasting. |

Average Days Per Month | Average number of days per month. |

Treasury Bank Account | Bank account of the ministry of finance. |

Is For Pensions | If checked indicates pensions are available. |

Description | Pay Code description. |

Pay Period Tab | Defines the Pay Period for the Pay Code. |

Pay Period Tab

Overview

This entity includes the list of pay periods with associated pay dates, Work From and Work To dates.

Pay Period Tab screen Fields

Field | Description |

Pay Period Number | System generated pay period number. |

Pay Period Status | Defines the status of the Pay Period. |

Pay Date | Defines the Pay Date for the Pay period. |

Default Data Entry cutoff date | Defines the last date for data entry of Pay Period. |

Default Approval cutoff date | Defines the last date for Approval of Pay Period. |

Work From | The starting date for pay period. |

Work To | The end date for pay period. |

Fiscal Year | The current fiscal for the pay period. |

Is Supplementry | This identifies if a pay period is a supplementary pay period. |

Generate Retroactive Payments | If checked, indicates that this pay period generates the retroactive payments. |

Adjustment Rate | Defines the adjustment rate for the pay period. |

Autonomous Administrative Unit

Overview

This entity will be used to register those institutions that have multiple Administrative Units and that request to have a group of TXT files (header and details) for each Administrative Unit separately.

Navigation

Payroll Management ► Support Entities ► Autonomous Administrative Unit

Autonomous Administrative Unit Screen Fields

| Fields | Description |

| Id | Autonomous Administration Unit Id is the unique Code that system automatically generated. |

| Institution | Institution Application Id. Must be the highest hierarchy institutional level Application Id. |

| Created By | User Application Id, automatically updated by system. |

| Created On | Date and time of register, automatically updated by system. |

Employee Invoice

Institution Paid Through Ifmis

Overview

This entity allows users to configure the institutions to be paid through IFMS instead of being paid throuch CSM. The system use this entity to know if this institution is paid through financials or if it follows the normal procedure of being paid through our payment batch salary summaries.

A screenshot of the Institution Paid Through Ifmis feature is available here. Image shown as reference material; position and names for labels, fields and buttons are subject to parameter, rendering control configuration and installed revision.

Users access Institution Paid Through Ifmis from within the menu through this navigation path: Payroll Management ►Support Entities ►Employee Invoice ►Institutions Paid through IFMIS

Visible Fields

The following table lists and describes all visible fields for the Institution Paid Through Ifmis feature, in their default order. Note that some fields depend on System Parameters and rendering control configuration to be visible and/or editable by users. Field names are subject to change through language label configuration.

| Field | Description |

| Institution | Insitution to be paid through financials. |

| Active | Indicates if the institution is active. The default value of the active checkbox is true. |

Buttons

The following table describes actions associated to the depicted button image. Note that some images are associated with several buttons, used for more than one purpose within the Institution Paid Through Ifmis feature.

| Button Image | Description |

|---|---|

| The New button allows users to switch to insert mode. This action button allows users to manually create expense vouchers. |

| The Save button allows users to save the record. This action button allows users to save manually create Institution Paid Through Ifmis. |

Unapplied Payments

Overview

This function stores all payments that were set as rejected in Payment Control Table.

Unapplied Payment Error

The Unapplied Payments Error screen enables users to create a record that describes the error in short and generates an error ID.

Unapplied Payment Error

Overview

The Unapplied Payments Error screen enables users to create a record that describes the error in short and generates an error ID.

Navigation

Payroll Management ► Support Entities ► Unapplied Payments ► Unapplied Payment Errors

Unapplied Payment Error screen Fields

Field | Description |

Id | Error Id is the unique Cost Item ID entered by the user. |

Error Message | Short description of error. |

Employee Payroll Settings

Automatic Cost Items

Overview

When an employee's pay is calculated, all cost items and/or allowances must be determined before finalizing the earnings. Some cost items are added manually, while other cost items are standardized and accumulate automatically. Automatic Cost Items are those identified with an assignment to apply for every pay period covering the assignment. This function lists all the necessary details of a cost item and allows the user to search, create, modify and delete a cost item. Any required additional information can be included by the Attachments section at the bottom of the screen.

Navigation

Payroll Management ► Employee Payroll Settings ► Automatic Cost Items

Automatic Cost Item screen Fields & Tab

Field | Description |

Employee | Employee unique identification code, selected using the look-up button. |

Employee Assignment | Employee Assignment unique identification code, selected using the look-up button. |

Cost Item | Cost Item code, selected using the look-up button. |

Start Date | Start date of the automatic cost item. |

End Date | End date of the automatic cost item. |

| Tax Exemption Code | Allows to select Tax Exemption code from the drop down list. |

Is For Previous Earning Period | Period Indicates if the Automatic Cost Item is for the previous earning period. |

Number of Hours Or Days | Number of Hours or Days associated with the Cost Item. |

Maximum Per Pay | Maximum amount per pay. |

Monthly Maximum Amount | Maximum allowed per month. |

Annual Maximum Amount | Annual maximum allowed. |

Debit Coding Block | Debit Financial Coding Block. This entry is optional. If not entered, the default code is used from Cost Items or Automatic Cost Items. If there is no Cost Item coding, the Debit Financial Coding Block is from Employee Assignment. |

Credit Coding Block | Credit Financial Coding Block. This entry is optional. If not entered, the default code is used from Cost Items or Automatic Cost Items. If there is no Cost Items coding, the Credit Financial Coding Block is from Employee Assignment. |

Explanation | Detailed description of the Automatic Cost Item. |

Attachment Tab | It allows attaching files that the Institution may consider relevant for supporting the Automatic Cost Item. Each file may have a Title, Description, Date, User, and document Language. |

Attachment Tab

Overview

It allows attaching files that the Institution may consider relevant for supporting the Automatic Cost Item. Each file may have a Title, Description, Date, User, and document Language.

Attachment Tab screen Fields

Field | Description |

Id | System generated identification for the Attachment. |

Title | Name of the Attachment. |

Description | Detailed description of the Attachment. |

Attachment Classification | Reference to attachment classification. |

Date | Creation date of the Attachment; automatically generated upon saving the Attachment. |

| User | Creation user name |

Automatic Deductions

Overview

Most deductions are established in advance for multiple pay periods. When an employee's pay is calculated, all deductions must be determined before finalizing the pay. Automatic deductions are standardized and accumulate automatically when the payroll is calculated. Automatic deductions are those identified with an assignment, which apply to every pay period in which the employee is included. This screen allows automatic deductions to be linked to individual employees and the specific assignment they apply to. The automatic deductions defined on this screen also appear in the Employee Assignment once approved. The specifications of these deductions are generated on each scheduled pay period automatically.

A screenshot of the Automatic Deductions feature is available here. Image shown as reference material; position and names for labels, fields and buttons are subject to parameter, rendering control configuration and installed revision.

Users access Automatic Deductions from within the menu through this navigation path:Payroll Management ► Employee Payroll Settings ► Automatic Deductions

Visible Fields

The following table lists and describes all visible fields for the Automatic Deductions feature, in their default order. Note that some fields depend on System Parameters and rendering control configuration to be visible and/or editable by users. Field names are subject to change through language label configuration.

Field | Description |

|---|---|

Employee | Employee code. |

Employee Assignment | Assignment ID retrieved from the employee assignment screen. Available only in search mode. |

Deduction | Deduction code assigned to the employee. |

Deduction Start Date | Start date of automatic deduction. |

Deduction End Date | End date of automatic deduction. |

| Reference Number | This field is used to maintain external account numbers e.g. loan numbers. |

Automatic Deduction Updater | This gets updated by the system depending on the process that created the record. |

Vendor | This can be left empty but users can only pick one vendor only. |

Is In Arrears | If checked, the deduction is deferred. |

Amount | A deduction amount that is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Rate | Percentage rate of deduction that is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Exemption | Exemption amount before this deduction is to be applied. This value is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Minimum Salary | Minimum salary for this deduction to be applied to. This value is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Financial Coding Block Debit | Debit financial coding block. This entry is optional. If not entered, the default coding is used from deductions or automatic deductions. If there are no deductions coding, it comes from employee assignment. |

Financial Coding Block Credit | Credit financial coding block. This entry is optional. If not entered, the default coding is used from deductions or automatic deductions. If there is no deductions coding, it comes from employee assignment. |

Max Cumulative Deduction | The maximum cumulative deductions are specific to the automatic deduction and can be entered to control the value of this deduction. Plus the cumulative amount paid to date would also be displayed. When the maximum amount has been reached, the system automatically ends the automatic deduction. |

Explanation | Detailed description as to why the automatic deductions was customized. |

| Language | Language used to enter explanation. |

Attachment Tab | Using this tab, users attach one or more files related to the expense voucher. File types allowed are specified in system parameters. |

| Automatic Deduction Cost Item Tab | Using this tab, users store automatic deduction cost item related to the automatic deduction. |

| Button Image | Description |

|---|---|

| The New button allows users to switch to insert mode. This action button allows users to manually create expense vouchers. |

| The Search button allows users to switch to search mode. |

| The Workflow History button displays a summary table of the executed workflow transitions for the selected expense voucher. |

| Calendar date-pickers allows users to select on a visual calendar a specific date. Within Expense Voucher, it is used to select the voucher date, invoice date and invoice receipt date. |

| The New button allows users to add details to the selected tab. It is used to add expense voucher line items, expense voucher payment details and attachments. |

| The Transition button allows users to execute the selected workflow status change. When selected, users are prompt with a window to log any relevant information about the status change. | |

| The Generate Data Import Template button allows users to generate the import template. |

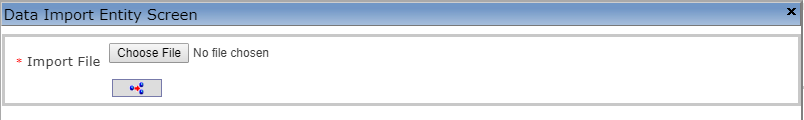

| The Execute Date Import button allows users to import a file from outside the GRP. When clicking the icon, a screen appears:

|

Attachment Tab

Overview

Attachment tab allows users to attach files for supporting the automatic deduction.

Visible Fields

Field | Description |

Id | Unique identification code for the transaction, this field’s value is assigned by the system or provided by users depending on System Parameters. |

Title | Name of the attachment. |

Description | Detailed description of the attachment. |

Attachment Classification | Reference to attachment classification. |

| Attachment | Button for navigating the file and attach to the screen. |

Date Time | Date and time of the last operation performed on the attachment document, automatically generated upon saving the Attachment. |

| Date | This attribute classifies the attribute in terms of date and used as a reference for Reports and Forms. |

| Language | Language used to enter title and description. |

User | The user who added the attachment, automatically generated by the system. |

Employee Deduction Rule

Overview

An Employee's pay will include at least one type of deduction that is put into place by law or the choice of the employer or employee. These deductions follow standards and regulations during the payroll calculation process. The Employee Deduction Rule screen provides the ability to regulate how a deduction is used on an employee's earnings. This function will define when a deduction is set to begin and the amount the deduction will be. It also describes the maximum amount the deduction is allowed to be in specified time periods, such as monthly and yearly maximum amounts. These rules can be created, modified and deleted and searches can be performed.

Navigation

Payroll Management ► Employee Payroll Settings ► Employee Deduction Rule

Employee Deduction Rule screen Fields

Field | Description |

Employee | Employee Unique Identification Code. |

Deduction | Deduction Unique Identification Code. |

Automatic Deduction | Automatic deduction previously created. |

New Maximum By Pay | Maximum deduction amount allowed per pay. |

New Monthly Maximum Amount | Maximum deduction amount allowed per month. |

New Annual Maximum Amount | Annual maximum deduction amount allowed. |

Start Date | Date at which the deduction rule will take effect. |

End Date | Date at which the deduction rule will stop. |

Past Maximum Age | If checked, the deduction will continue to be in affect past its expiry date. |

Occurrences by fiscal year | Number of occurrences in the fiscal year. |

Accumulated Benefit Request

Overview

This screen contains information regarding Accumulated Benefits requests. Accumulated benefits requests can be either PAYMENT or TRANSFER. Each request is put in individually and includes a date, pay code, status, employee and employee assignment information.

Once the Request has been approved, then records will be created automatically in cost items per period. Once the records have been created in Cost items per period, during the payroll calculation the entity Summary of Accumulated Benefits will be updated.

Navigation

Payroll Management ► Employee Payroll Settings ► Accumulated Benefit Requests

Accumulated Benefit Request screen Fields

Field | Description |

Id | Accumulated Benefit Request ID is system generated. |

Workflow Status | It is updated by the system. Depending on the Workflow Configuration Setting the basic Stages are ‘Created’, ‘Approval Requested’, ‘Approved’, ‘Rejected’, 'Cancelled', 'Template'. |

Request Date | This is the date of request. |

Request Process | The request process can be Payment or Transfer. |

Employee | Employee having an accumulated benefit. |

Accumulated Benefit Summary | This contains the summary of Accumulated Benefit. |

Fiscal Year | This is the applicable year. |

Pay Code | Filter criteria to filter the screen by Pay Code |

Pay Period | Filter criteria to filter the screen by Pay Period |

To Accumulated Benefit | The user needs to select the Accumulated Benefit. |

Loan Deduction Export

Overview

This screen allow users to Export the Loan Deduction made previously for reporting purpose.

Navigation

Payroll Management ► Employee Payroll Settings ► Loan Deduction Export

Loan Deduction Export Screen Fields

| Fields | Description |

| Fiscal Year | Fiscal year of the Loan Deduction. |

| Pay Code | Pay Code of the employee payroll. |

| Pay Period | Pay period of the employee payroll. |

Loan Deduction Import

Overview

In this interoperation, IPPS will provide the details of employees and corresponding pay-slip details (allowances and deductions) of a particular pay period where as PSU will return the verified deduction (loans & hire purchase) details of employees for the next pay period.

Navigation

Payroll Management ► Employee Payroll Settings ► Loan Deduction Import

Loan Deduction Import Screen Fields

| Fields | Description |

| Loan Deduction Import | This fields allows user to choose import file. |

| Import Date | Import date and time of the file. It’s automatically updated by the system. |

| Effective Date | Date when the loan amount going the effect the deduction. |

Importing a Loan Deduction

To IMPORT an Loan Deduction File, follow the steps below:

Navigation

By default, you will be in Insert Mode.

1. Enter the new Loan Deduction information. Fields with an asterisk  are mandatory fields.

are mandatory fields.

2. Click  to attach an Loan Deduction File

to attach an Loan Deduction File

3. The Import Date will be automatically generated.

- Import Date: the date the loan deduction is imported

4. Enter the Effective Date using the calendar ![]() .

.

- Effective Date: this is the start date for the loan deduction

5. Click on the Import button at the bottom of the page to Import the Loan Deduction File. A window will appear to confirm the new Loan Deduction import. Click OK to confirm

Loan Deduction Import Results

Overview

The Loan Deduction Results screen allows the user to retrieve the previously generated Loan Deduction file. The file retrieved is the file that comes from Payment Solution Uganda (PSU).

Navigation

Payroll Management ► Employee Payroll Settings ► Loan Deduction Import Results

Loan Deduction Import Results screen includes the following fields:

| Field | Definition |

| Correlative Id | unique identification number for the file |

| Element Code | first segment of the financial coding block |

| Employee | Employee associated with the deduction loan |

| Employee Assignment | Employee Assignment associated with the deduction loan |

| Ministry of Departments | name of the Ministry associated to the employee |

| Deduction | the unique identification number associated to the loan deduction |

| Payroll | type of payroll associated with employee (traditional or teacher) |

| Amount | loan amount |

| Employee Deduction Counter | how many payments left |

| Action | action of the loan (A-Add, D-Delete, T-Top Up) |

| Vendor | represents the bank that is giving the loan to the employee |

| Status | the status of the loan |

| Import Date | the date the deduction loan was imported |

| Effective Date | the starting date for the loan |

| Remarks | additional Remarks or Comments |

Yearly Maximum Cost Item validation

Overview

The salary found in the salary transition is the salary to be used. If the cost item scale frequency rate is equal to the hourly or daily or weekly or monthly then the amount has to be converted into annual when doing this validation. If the validation fails then the employees pay does not get paid.

Navigation

Payroll Management ► Employee Payroll Settings► Maximum Yearly Cost Item Validation

Yearly Maximum Cost Item validation Screen Fields

| Fields | Description |

| Validation Type | Specifying the type of validation. |

| Active | If it is checked that means the record is active |

| Cost Item Tab | It specifies the cost item details. |

Employee Payroll Results

Cost Items Per Period

Overview

Cost Items Per Period are specific to a single pay period and can be modified by authorized users until the pay is closed. They can be created by authorized users to accommodate one-time Cost Items.

More commonly, Cost Items Per Period will be created during the calculation of an employee’s pay. When the Pay Calculation is executed, the Automatic Cost Items are copied over to the Cost Items Per Period and are processed. If a pay is recalculated, the set of previously created Cost Items Per Period is replaced by a new set except for any Cost Items Per Period which were user-created or modified.

Once a pay is closed, all Cost Items Per Period become available for viewing purposes only and cannot be modified or deleted.

Navigation

Payroll Management ► Employee Payroll Results► Cost Items Per Period

Cost Item Per Period screen Fields and Tab

Field | Description |

Employee | The employee which is assigned to this specific Deduction Per Period. |

| Workflow Status | Workflow Status of the cost item per period |

Employee Assignment | Assignment associated to this Cost Item Per Period. |

Accumulated Benefits To Zero | This field is unchecked by default and is updated by the Accumulated Benefits function. It is used by the Payroll calculation. |

Accumulated Benefits Transfer | This field is unchecked by default and is updated by the Accumulated Benefits function. It is used by the Payroll calculation. |

Automatic | If checked, indicates that this Cost Item Per Period was automatically copied by the application, from the Automatic Cost Items |

Is Auto Modified | This indicator is checked if the following criteria are met Status Approved, Automatic is checked, and Transaction Type is set to Regular. Furthermore, if any of the values for Amount For Frequency, Number of Hours or Days, Cost Item Scale Group, Cost Item Scale, Cost Item Scale Level, Scale Step, Debit Coding Block, Credit Coding Block, and Corrected Amount are different, Auto Modified must be checked. |

Retroactive | This field is from the Payroll calculation, is false by default and not editable. |

Status | By default the value is Not Processed. When the Payroll Calculation is executed, the application will look for those with the status Not Processed and Calculated, validate and process them, and then set the status to Calculated if they were successfully processed. When the calculated pay for the selected pay period is finalized, the status of these records will be set to Finalized and the user will be unable to edit or delete these records. When a Payment Cancellation is done, this attribute is set to Cancelled. |

Transaction Type | Possible values are Regular, Time and Attendance, Accumulated Benefit and Entitlement. When recording time information through Time and Attendance, this field is set to Time and Attendance. If the Cost Item Per Period is created through the Accumulated Benefits function, this field is set to either Accumulated Benefit or Entitlement. For all other cases, this field is set to Regular. |

Fiscal Year | Fiscal Year, from the drop-down menu. |

Rate | Field that the user can use to enter a new value to customize the employee’s deduction per period. By default, the Rate from the Deductions screen, if populated, is included in this field. This value can be overridden. |

Pay Code | Pay Code that the employee is assigned to. |

Number of Pay Periods | Pay Period Number indicator |

Start Date | The start date of the automatic cost items. By default, the start date of the pay period is populated in this field. The user can override the date. Cannot be greater than the pay period end date. |

End Date | The end date of the automatic cost items. Cost Item End Date should be greater or equal to the Cost Item Start Date. By default, the pay period end date is populated in this field. The user can override the date. Cannot be greater than the pay period end date. |

Cost Item | Cost Item associated to the Cost Item Per Period. |

Number Of Hours Or Days | Number of hours or days concerned with the Cost Item Per period |

Debit Coding Block | Financial Coding Block associated to the Debit. This entry is optional. If not entered, the default code is from Cost Items or Automatic Cost Items. If there is no Cost Item coding, it will come from Employee Assignment. |

Credit Coding Block | Financial Coding Block associated to the Credit. This entry is optional. If not entered, the default code is used from Cost Items or Automatic Cost Items. If there is no Cost Item coding, it will come from Employee Assignment. |

Reason | Field to specify why the cost item is being paid to the employee. |

Task | Specifies the type of task the employee did. |

Corrected Amount | Corrected amount of the cost item per period |

Calculated Amount | This field is not editable and is automatically updated during the Payroll Calculation. This amount is displayed on the employee’s pay stub. |

Taxable Amount | The amount that is taxable. |

Accumulated Benefit | Displays the default value of Accumulated Benefit from the Cost Items screen and is not editable. |

Effect on Accumulated Benefit | Displays the default value of Effect on Accumulated Benefit from the Cost Items screen and is not editable. |

Explanation | Field to enter a short explanation about the Cost Item Per Period. This field is mandatory if a value is entered in the field Cost Item Corrected Amount. |

Attachment Tab | Cost Item Per Period can have 0 or more documents attached to it. |

Attachment Tab

Overview

It allows users to attach external file to Cost Item Per Period.

Attachment Tab screen Fields

Field | Description |

Id | System generated identification for the Attachment. |

Title | Name of the Attachment. |

Description | Detailed description of the Attachment. |

Attachment | Button for navigating the file and attach to the screen. |

Date Time | Creation date of the Attachment; automatically generated upon saving the Attachment. |

User | The user who added the Attachment; automatically generated. |

Deductions Per Period

Overview

The Deduction Per Period screen holds details of each deduction applicable to an employee for a pay period. The period deductions are used to produce the payroll calculation for the employee and to provide a history of all the deductions applicable to the employee in each pay period. These records can be created and modified by authorized users to accommodate for one-time deductions.

When the payroll calculation is executed, the employee's automatic deductions are copied to the Deduction Per Period screen and all the calculations are based on those records.

Once the pay period is closed, all period deductions become available for viewing purposes only and cannot be modified or deleted. They remain in the system in order to provide payroll details.

Navigation

Payroll Management ► Employee Payroll Results ► Deductions Per Period

Deductions Per Period screen Fields and Tab

Field | Description |

Employee | The employee which is assigned to this specific Deduction Per Period. |

| Workflow Status | Workflow Status of the Deductions Per Period |

Employee Assignment | Assignment associated to this Deduction Per Period. |

Deduction | Deduction Unique Identification Code associated to this Deduction Per Period. |

| Vendor | Allows to select vendor from the lookup |

Is Automatic | If checked, indicates that the Deduction Per Period was automatically copied by the application. |

Is Arrears | If checked, the deduction is in arrears, as generated by the Payroll calculation. This field is not editable |

| Is Auto Modified | Default value is FALSE |

Periodic Deduction Calculated | This database field is not editable and is automatically updated during the Payroll Calculation. It is this amount that will be displayed on the employee’s pay stub. |

Periodic Deduction Corrected | Periodic Deduction Corrected amount. After doing the Payroll calculation and if the pay period is not yet closed, the user can make modifications. If an amount is entered in this field, then this value has precedence |

Deduction Per Period Status | This field is not editable and is set to Not Processed by default. Possible values are Not Processed, Calculated, Finalized, Cancelled and Inactivated. |

| Fiscal Year | Allows to select fiscal year from the drop down list. |

Pay Code | The pay code for the period deduction. |

Pay Period Number | The pay period number for the period deduction. |

Is Retroactive | This field is not editable and is checked by a Payroll procedure that creates retroactive transactions. |

Amount | Field that the user can use to enter a new value to customize the employee’s deduction per period. By default, the Amount from the Deductions screen, if populated, is included in this field. This value can be overridden. |

Rate | Field that the user can use to enter a new value to customize the employee’s deduction per period. By default, the Rate from the Deductions screen, if populated, is included in this field. This value can be overridden. |

Exemption | Editable field that the user can use to enter a new value to customize the employee’s deduction per period. By default, the Exemption from the Deductions screen, if populated, is included in this field. This value can be overridden. |

Minimum Salary | Editable field that the user can use to enter a new value to customize the employee’s deduction per period. By default, the Minimum Salary from the Deductions screen, if populated, is included in this field. This value can be overridden. |

| Reference Number | Loan reference number |

Financial Coding Block Credit | Credit Financial Coding Block for the Deduction Per Period. This entry is optional. If not entered, the default financial coding is from Cost Items or Automatic Cost Items. If there is no Cost Item Financial Coding, the coding will be from the Employee Assignment. |

Financial Coding Block Debit | Debit Financial Coding Block for the Deduction Per Period. This entry is optional. If not entered, the default financial coding is used from Cost Items or Automatic Cost Items. If there is no Cost Item Financial Coding, the coding will be from the Employee Assignment. |

Explanation | Available to provide a short explanation about the Deduction Per Period. This attribute is mandatory if a value is entered under Periodic Deduction Corrected Amount. |

| Language | Country specific language used to register the description. |

Attachment Tab | Deductions per period can have 0 or more documents attached to it. |

Attachment Tab

Overview

It allows users to attach external file to Deductions Per Period.

Attachment Tab screen Fields

Field | Description |

Id | System generated identification for the Attachment. |

Title | Name of the Attachment. |

Description | Detailed description of the Attachment. |

Attachment | Button for navigating the file and attach to the screen. |

Date Time | Creation date of the Attachment; automatically generated upon saving the Attachment. |

User | The user who added the Attachment; automatically generated. |

Cost Items Per Period Target Stage

Overview

This process will allow the user to execute a workflow transition for many Cost Item Per Period.

Navigation

Payroll Management ► Employee Payroll Results ► Cost Item Per Period Target Stage

Cost Item Per Period Target Stage Screen Fields

| Fields | Description |

| Employee | Employee id of the cost item per period. |

| Employee Assignment | Employee assignment id |

| Is Automatic | It indicates automatic cost item per period |

| Status | Status of the cost item per period. |

| Fiscal Year | Fiscal year of the cost item per period. |

| Pay Code | Pay Code of the cost item Per Period from employee assignment. |

| Pay Period Number | Pay period of the employee payroll. |

| Cost Item | Cost item code of the cost item per period. |

| Application User | Automatically populated by the system when the form is displayed, Read Only field. |

| Origin | Origin of the cost item per period. |

| Target Stage | Workflow target stage, The value to be displayed will depend on the stages configured on the Workflow Process. |

Deduction Per Period Target Stage

Overview

This process will allow the user to execute a workflow transition for many Deduction Per Period.

Navigation

Payroll Management ► Employee Payroll Results ► Deduction Per Period Target Stage

Cost Item Per Period Target Stage Screen Fields

| Fields | Description |

| Employee | Employee id of the Deduction Per Period. |

| Employee Assignment | Employee assignment id |

| Is Automatic | It indicates automatic Deduction Per Period |

| Status | Status of the Deduction Per Period. |

| Fiscal Year | Fiscal year of the Deduction Per Period. |

| Pay Code | Pay Code of the Deduction Per Period from employee assignment. |

| Pay Period Number | Pay period of the employee payroll. |

| Application User | Automatically populated by the system when the form is displayed, Read Only field. |

| Origin | Origin of the Deduction Per Period. |

| Target Stage | Workflow target stage, The value to be displayed will depend on the stages configured on the Workflow Process. |

Payroll Transaction Processing

Payroll Calculation

Calculate Regular Payroll

Overview

Payroll managers use the Calculate Regular Payroll application to determine the employees pay based on the Fiscal Year, Pay Code, Pay Period, and the chosen Institutions. Fiscal Year is a fundamental component of FreeBalance Accountability Platform. Budgets are created per fiscal year, transactions are posted for a particular fiscal year, reports are generated by fiscal year, analysis is performed comparing results from fiscal year to fiscal year and so on, etc. A fiscal year may not correspond to a calendar year. Pay Code allows every employee to have a specified time when he or she will get paid. This selected schedule of pay depends on the pay details associated with the employee position and the institution where he/she works (i.e. Ministry of Transportation).

Navigation

Payroll Management ► Payroll Transaction Processing ► Payroll Calculation ► Calculate Regular Payroll

Calculate Regular Payroll screen Fields

Field | Description |

Fiscal Year | Fiscal Year of the Payroll Calculation. |

Pay Code | Pay Code associated to the Payroll Calculation. |

Pay Period | Pay Period of the Payroll Calculation. |

Employee | Employee for which Payroll Calculation is performed. |

Institutions | Identifies which organization the payroll is based on or being calculated for (i.e., Ministry of Finance). |

Calculate Cost Items

The CALCULATE Cost Items step is comprised of the following functions:

- Generate an employee net pay number, after verification that the pay has not already been finalized.

- Find the cost items previously calculated to determine if the pay was already calculated. If so, reverse the summary of accumulated benefits, reverse the cumulate hours, change status of the cost items per period to Not Processed, reduce the arrears and payments amounts, before the pay is re-calculated.

- Check for retroactive transactions, and create the cost items and deductions per period, for these retroactive transactions.

- Copy the automatic cost items in cost items per period. Most of the time, one (1) automatic cost item will create one (1) cost item per period. However if there is a new salary transition, certain cost items need to be split to reflect the new salary. Also, if a cost item has a new cost item effective date, this would mean that part of the month, the cost item is one amount and the other part it is another amount, so again the system will need to create multiple cost items per period to reflect this.

- Calculation of Statutory Holidays. The system must verify if there were any statutory holidays during the pay period being calculated or any statutory holiday for the retroactive transactions, based on the Shift Schedule Definition of the employee assignment.

- Check if manual or retroactive cost items per period need to be split. For every record found in Cost Items Per Period with Frequency set to One time or Pay Period, and IsProRated set to True, the application will verify if any Salary Transition occurs between the Cost Item Start Date and End Date. If a Salary Transition occurs, the cost item per period will be split at the Salary Transition effective date.

- Verify and assign Accumulated Benefit entitlements. The application will verify the global variables associated to the Accumulated Benefits and verify if the employee for which the pay is calculated, is entitled to accumulated benefits as per Accumulated Benefit Entitlement. If Entitlement credits have already been generated, under Cost Items Per Period (Cost Item Transaction Type is set to Entitlement and State is set to Approved), the Number of Hours/Day/Unit is set based on the number of days under Accumulated Benefit Entitlement Detail.

- Find the Accumulated Benefit transfers balance, from Accumulated Benefits Summary . If the Accumulated Benefit Type is Daily of Hourly, the Number of Hours/Day/Unit of Cost Item Per Period is set to Balance, otherwise if Accumulated Benefit Type is Paid, Amount for Frequency is set to Balance.

- Calculate the value of the cost items per period. In cost items per period, there will be records coming from automatic cost items or cost items per period that were entered through the time and attendance module or cost items per period that were added manually through the cost items per period screen. The application will scan these cost items per period in order of sequence Cost Items. Only Cost Items Per Period that have a status not set to Cancelled nor Finalized, and a State set to Approved are calculated. Calculated Amount and Amount Limiting Regular Cost Item, from Period are determined at this step, based on a detailed algorithm.

- Apply the maximums. At this step, the Maximum by Pay, Monthly Maximum and Annual Maximum, from Cost Items Per Period are applied, if any.

- Apply penalties. At this step, the Employee Assignment Penalties are applied, if any.

- Update Accumulated Benefits. Summary of Accumulated Benefits fields, including Accumulated, Credit, Debit, Taken, Paid and Balance are updated, based on the Effect on Accumulated Benefit, from Cost Item Per Period.

- Set other attributes in cost items per period. If no error was generated during the previous steps, the fields Employee net Payment, Sequence Calculated, from Cost Items Per Period are set to the values determined, and the status is set to 'Calculated'.

- Update the cumulated hours, based on the Number of Hours/Day/Unit, from Cost Item Per Period.

- Check for remaining balances in accumulated benefits. If the global parameter Accumulated Benefit = TRUE and the global parameter Gregorian Calendar = TRUE, the application will verify if the pay period is the last pay period before the new year and if so, will verify that every Summary of Accumulated Benefit has a balance of zero. If the balance is not zero, the following error will be generated: "The year end procedure for the Accumulated Benefits has not been done. This employee cannot be calculated. Please execute the year end procedure and recalculate". The application also verified if any assignments ended and there are remaining balances. If so, the following error will be generated:"The employee's assignment has ended and has remaining balances. Accumulated Benefit transfers need to be generated before pay can be calculated."

Calculate Deduction Items

To CALCULATE Deductions, the following actions must be performed:

- Copy automatic deductions into Deductions per Period

- Validate Minimum Salary. If the sum of the Cost Item Corrected Amount or Calculated Amount, from Cost Items per Period, as applicable, for each Cost Item marked as Is Basic Salary, is less than the Minimum Salary specified under Automatic Deductions , the Period Deduction Calculated Amount is set to zero (0), under Deductions Per Period.

- Calculate the amounts of the deductions based on other deductions.

The deductions have to be calculated in the order of sequence, specified under Deductions . This step includes the calculation of Period DeductionsCalculated Amount based on other deductions previously calculated, with a smaller sequence order, less any exemption specified under Deductions per Period.

- Fixed amount Deductions. This step includes the calculation of Period DeductionsCalculated Amount based on fixed amount.

- Deductions based on cost items (deduction type N/A). Calculates the Period Deduction Calculated Amount for Deductions based on cost items, as specified under Deductions , if Deduction Type is set to N/A.