Employee Payroll Settings

Automatic Cost Items

Overview

When an employee's pay is calculated, all cost items and/or allowances must be determined before finalizing the earnings. Some cost items are added manually, while other cost items are standardized and accumulate automatically. Automatic Cost Items are those identified with an assignment to apply for every pay period covering the assignment. This function lists all the necessary details of a cost item and allows the user to search, create, modify and delete a cost item. Any required additional information can be included by the Attachments section at the bottom of the screen.

Navigation

Payroll Management ► Employee Payroll Settings ► Automatic Cost Items

Automatic Cost Item screen Fields & Tab

Field | Description |

Employee | Employee unique identification code, selected using the look-up button. |

Employee Assignment | Employee Assignment unique identification code, selected using the look-up button. |

Cost Item | Cost Item code, selected using the look-up button. |

Start Date | Start date of the automatic cost item. |

End Date | End date of the automatic cost item. |

| Tax Exemption Code | Allows to select Tax Exemption code from the drop down list. |

Is For Previous Earning Period | Period Indicates if the Automatic Cost Item is for the previous earning period. |

Number of Hours Or Days | Number of Hours or Days associated with the Cost Item. |

Maximum Per Pay | Maximum amount per pay. |

Monthly Maximum Amount | Maximum allowed per month. |

Annual Maximum Amount | Annual maximum allowed. |

Debit Coding Block | Debit Financial Coding Block. This entry is optional. If not entered, the default code is used from Cost Items or Automatic Cost Items. If there is no Cost Item coding, the Debit Financial Coding Block is from Employee Assignment. |

Credit Coding Block | Credit Financial Coding Block. This entry is optional. If not entered, the default code is used from Cost Items or Automatic Cost Items. If there is no Cost Items coding, the Credit Financial Coding Block is from Employee Assignment. |

Explanation | Detailed description of the Automatic Cost Item. |

Attachment Tab | It allows attaching files that the Institution may consider relevant for supporting the Automatic Cost Item. Each file may have a Title, Description, Date, User, and document Language. |

Attachment Tab

Overview

It allows attaching files that the Institution may consider relevant for supporting the Automatic Cost Item. Each file may have a Title, Description, Date, User, and document Language.

Attachment Tab screen Fields

Field | Description |

Id | System generated identification for the Attachment. |

Title | Name of the Attachment. |

Description | Detailed description of the Attachment. |

Attachment Classification | Reference to attachment classification. |

Date | Creation date of the Attachment; automatically generated upon saving the Attachment. |

| User | Creation user name |

Automatic Deductions

Overview

Most deductions are established in advance for multiple pay periods. When an employee's pay is calculated, all deductions must be determined before finalizing the pay. Automatic deductions are standardized and accumulate automatically when the payroll is calculated. Automatic deductions are those identified with an assignment, which apply to every pay period in which the employee is included. This screen allows automatic deductions to be linked to individual employees and the specific assignment they apply to. The automatic deductions defined on this screen also appear in the Employee Assignment once approved. The specifications of these deductions are generated on each scheduled pay period automatically.

A screenshot of the Automatic Deductions feature is available here. Image shown as reference material; position and names for labels, fields and buttons are subject to parameter, rendering control configuration and installed revision.

Users access Automatic Deductions from within the menu through this navigation path:Payroll Management ► Employee Payroll Settings ► Automatic Deductions

Visible Fields

The following table lists and describes all visible fields for the Automatic Deductions feature, in their default order. Note that some fields depend on System Parameters and rendering control configuration to be visible and/or editable by users. Field names are subject to change through language label configuration.

Field | Description |

|---|---|

Employee | Employee code. |

Employee Assignment | Assignment ID retrieved from the employee assignment screen. Available only in search mode. |

Deduction | Deduction code assigned to the employee. |

Deduction Start Date | Start date of automatic deduction. |

Deduction End Date | End date of automatic deduction. |

| Reference Number | This field is used to maintain external account numbers e.g. loan numbers. |

Automatic Deduction Updater | This gets updated by the system depending on the process that created the record. |

Vendor | This can be left empty but users can only pick one vendor only. |

Is In Arrears | If checked, the deduction is deferred. |

Amount | A deduction amount that is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Rate | Percentage rate of deduction that is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Exemption | Exemption amount before this deduction is to be applied. This value is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Minimum Salary | Minimum salary for this deduction to be applied to. This value is retrieved from the deductions screen and used as a default value for viewing purposes. Can be customized if needed. |

Financial Coding Block Debit | Debit financial coding block. This entry is optional. If not entered, the default coding is used from deductions or automatic deductions. If there are no deductions coding, it comes from employee assignment. |

Financial Coding Block Credit | Credit financial coding block. This entry is optional. If not entered, the default coding is used from deductions or automatic deductions. If there is no deductions coding, it comes from employee assignment. |

Max Cumulative Deduction | The maximum cumulative deductions are specific to the automatic deduction and can be entered to control the value of this deduction. Plus the cumulative amount paid to date would also be displayed. When the maximum amount has been reached, the system automatically ends the automatic deduction. |

Explanation | Detailed description as to why the automatic deductions was customized. |

| Language | Language used to enter explanation. |

Attachment Tab | Using this tab, users attach one or more files related to the expense voucher. File types allowed are specified in system parameters. |

| Automatic Deduction Cost Item Tab | Using this tab, users store automatic deduction cost item related to the automatic deduction. |

| Button Image | Description |

|---|---|

| The New button allows users to switch to insert mode. This action button allows users to manually create expense vouchers. |

| The Search button allows users to switch to search mode. |

| The Workflow History button displays a summary table of the executed workflow transitions for the selected expense voucher. |

| Calendar date-pickers allows users to select on a visual calendar a specific date. Within Expense Voucher, it is used to select the voucher date, invoice date and invoice receipt date. |

| The New button allows users to add details to the selected tab. It is used to add expense voucher line items, expense voucher payment details and attachments. |

| The Transition button allows users to execute the selected workflow status change. When selected, users are prompt with a window to log any relevant information about the status change. | |

| The Generate Data Import Template button allows users to generate the import template. |

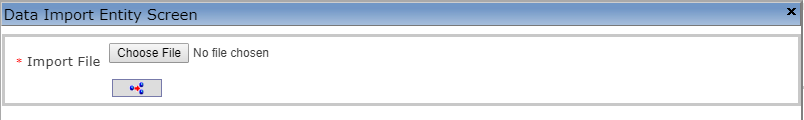

| The Execute Date Import button allows users to import a file from outside the GRP. When clicking the icon, a screen appears:

|

Attachment Tab

Overview

Attachment tab allows users to attach files for supporting the automatic deduction.

Visible Fields

Field | Description |

Id | Unique identification code for the transaction, this field’s value is assigned by the system or provided by users depending on System Parameters. |

Title | Name of the attachment. |

Description | Detailed description of the attachment. |

Attachment Classification | Reference to attachment classification. |

| Attachment | Button for navigating the file and attach to the screen. |

Date Time | Date and time of the last operation performed on the attachment document, automatically generated upon saving the Attachment. |

| Date | This attribute classifies the attribute in terms of date and used as a reference for Reports and Forms. |

| Language | Language used to enter title and description. |

User | The user who added the attachment, automatically generated by the system. |

Employee Deduction Rule

Overview

An Employee's pay will include at least one type of deduction that is put into place by law or the choice of the employer or employee. These deductions follow standards and regulations during the payroll calculation process. The Employee Deduction Rule screen provides the ability to regulate how a deduction is used on an employee's earnings. This function will define when a deduction is set to begin and the amount the deduction will be. It also describes the maximum amount the deduction is allowed to be in specified time periods, such as monthly and yearly maximum amounts. These rules can be created, modified and deleted and searches can be performed.

Navigation

Payroll Management ► Employee Payroll Settings ► Employee Deduction Rule

Employee Deduction Rule screen Fields

Field | Description |

Employee | Employee Unique Identification Code. |

Deduction | Deduction Unique Identification Code. |

Automatic Deduction | Automatic deduction previously created. |

New Maximum By Pay | Maximum deduction amount allowed per pay. |

New Monthly Maximum Amount | Maximum deduction amount allowed per month. |

New Annual Maximum Amount | Annual maximum deduction amount allowed. |

Start Date | Date at which the deduction rule will take effect. |

End Date | Date at which the deduction rule will stop. |

Past Maximum Age | If checked, the deduction will continue to be in affect past its expiry date. |

Occurrences by fiscal year | Number of occurrences in the fiscal year. |

Accumulated Benefit Request

Overview

This screen contains information regarding Accumulated Benefits requests. Accumulated benefits requests can be either PAYMENT or TRANSFER. Each request is put in individually and includes a date, pay code, status, employee and employee assignment information.

Once the Request has been approved, then records will be created automatically in cost items per period. Once the records have been created in Cost items per period, during the payroll calculation the entity Summary of Accumulated Benefits will be updated.

Navigation

Payroll Management ► Employee Payroll Settings ► Accumulated Benefit Requests

Accumulated Benefit Request screen Fields

Field | Description |

Id | Accumulated Benefit Request ID is system generated. |

Workflow Status | It is updated by the system. Depending on the Workflow Configuration Setting the basic Stages are ‘Created’, ‘Approval Requested’, ‘Approved’, ‘Rejected’, 'Cancelled', 'Template'. |

Request Date | This is the date of request. |

Request Process | The request process can be Payment or Transfer. |

Employee | Employee having an accumulated benefit. |

Accumulated Benefit Summary | This contains the summary of Accumulated Benefit. |

Fiscal Year | This is the applicable year. |

Pay Code | Filter criteria to filter the screen by Pay Code |

Pay Period | Filter criteria to filter the screen by Pay Period |

To Accumulated Benefit | The user needs to select the Accumulated Benefit. |

Loan Deduction Export

Overview

This screen allow users to Export the Loan Deduction made previously for reporting purpose.

Navigation

Payroll Management ► Employee Payroll Settings ► Loan Deduction Export

Loan Deduction Export Screen Fields

| Fields | Description |

| Fiscal Year | Fiscal year of the Loan Deduction. |

| Pay Code | Pay Code of the employee payroll. |

| Pay Period | Pay period of the employee payroll. |

Loan Deduction Import

Overview

In this interoperation, IPPS will provide the details of employees and corresponding pay-slip details (allowances and deductions) of a particular pay period where as PSU will return the verified deduction (loans & hire purchase) details of employees for the next pay period.

Navigation

Payroll Management ► Employee Payroll Settings ► Loan Deduction Import

Loan Deduction Import Screen Fields

| Fields | Description |

| Loan Deduction Import | This fields allows user to choose import file. |

| Import Date | Import date and time of the file. It’s automatically updated by the system. |

| Effective Date | Date when the loan amount going the effect the deduction. |

Importing a Loan Deduction

To IMPORT an Loan Deduction File, follow the steps below:

Navigation

By default, you will be in Insert Mode.

1. Enter the new Loan Deduction information. Fields with an asterisk  are mandatory fields.

are mandatory fields.

2. Click  to attach an Loan Deduction File

to attach an Loan Deduction File

3. The Import Date will be automatically generated.

- Import Date: the date the loan deduction is imported

4. Enter the Effective Date using the calendar ![]() .

.

- Effective Date: this is the start date for the loan deduction

5. Click on the Import button at the bottom of the page to Import the Loan Deduction File. A window will appear to confirm the new Loan Deduction import. Click OK to confirm

Loan Deduction Import Results

Overview

The Loan Deduction Results screen allows the user to retrieve the previously generated Loan Deduction file. The file retrieved is the file that comes from Payment Solution Uganda (PSU).

Navigation

Payroll Management ► Employee Payroll Settings ► Loan Deduction Import Results

Loan Deduction Import Results screen includes the following fields:

| Field | Definition |

| Correlative Id | unique identification number for the file |

| Element Code | first segment of the financial coding block |

| Employee | Employee associated with the deduction loan |

| Employee Assignment | Employee Assignment associated with the deduction loan |

| Ministry of Departments | name of the Ministry associated to the employee |

| Deduction | the unique identification number associated to the loan deduction |

| Payroll | type of payroll associated with employee (traditional or teacher) |

| Amount | loan amount |

| Employee Deduction Counter | how many payments left |

| Action | action of the loan (A-Add, D-Delete, T-Top Up) |

| Vendor | represents the bank that is giving the loan to the employee |

| Status | the status of the loan |

| Import Date | the date the deduction loan was imported |

| Effective Date | the starting date for the loan |

| Remarks | additional Remarks or Comments |

Yearly Maximum Cost Item validation

Overview

The salary found in the salary transition is the salary to be used. If the cost item scale frequency rate is equal to the hourly or daily or weekly or monthly then the amount has to be converted into annual when doing this validation. If the validation fails then the employees pay does not get paid.

Navigation

Payroll Management ► Employee Payroll Settings► Maximum Yearly Cost Item Validation

Yearly Maximum Cost Item validation Screen Fields

| Fields | Description |

| Validation Type | Specifying the type of validation. |

| Active | If it is checked that means the record is active |

| Cost Item Tab | It specifies the cost item details. |