Detailed Cost Item or Deduction Per Period Report

Overview

The Detailed Cost Item/Deduction Per Period report allows the user to view the list of employees who obtained the selected Cost Item/Deduction for the specified Pay Period

An example report is shown below.

Navigation

Definition of Report Fields

The Detailed Cost Item / Deduction Per Period Report includes the following fields:

| Report Fields | Description |

| Fiscal Year | Fiscal Year of report data |

| Report Generation Date | Date of report generation automatically generated by the system |

| Report Generation Time | Time of report generation automatically generated by the system |

| User | User who generates the report |

| Page | Indicates page number |

| Filter Criteria | User enters organization criteria |

| Group By | Used to group report information by Employee, Institution, Value |

| Deduction | Label of deduction the report is based upon |

| Employee Code | Employee Identification number |

| Employee Name | Employee's first and last name |

| Assignment # | Identification number for deduction assignment |

| Utilization Rate (%) | Percentage rate of utilization |

| Amount | Value of deduction |

| Rate | Percentage of deduction rate |

| Calculated Amount | Value of deduction |

| Corrected Amount | Value of deduction after correction |

| Cumulative | Total value of deductions to date |

| Total | Sum of deduction values |

Generation of the Report

The Detailed Cost Item/Deduction Per Period report allows the user to view the list of employees who obtained the selected Cost Item/Deduction for the specified Pay Period.

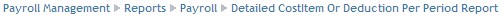

To GENERATE a Detailed Cost Item/Deduction Per Period Report, follow the steps below:

Navigation

The Detailed Cost Item / Deduction Per Period Report includes the following filter criteria available for the report:

- Fiscal Year - Select Fiscal Year from drop-down menu

- Pay Code - Select Pay Code from drop-down menu

- Pay Period - Select Pay Period from drop-down menu

- Employee - To enter the Employee, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Employee list, then select the Employee

to retrieve the Employee list, then select the Employee - Employee Position - To enter the Employee Position, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Employee Position list, then select the Employee Position

to retrieve the Employee Position list, then select the Employee Position - Report Type - Select Report Type from drop-down menu

- Cost Item - To enter the Cost Item, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Cost Item list, then select the Cost Item

to retrieve the Cost Item list, then select the Cost Item - Deduction - To enter the Deduction, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Deduction list, then select the Deduction

to retrieve the Deduction list, then select the Deduction - Situation Code Combination - To enter the Situation Code Combination, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Situation Code Combination list, then select the Situation Code Combination

to retrieve the Situation Code Combination list, then select the Situation Code Combination - Enter Group By information

- Group By - Select Group By from drop-down menu

- Select Group By Organization Unit

- Group By Institution Type - Select Group By Institution Type from drop-down menu

If all filter criteria are left blank, all Employees, Employee Positions, Cost Items, Deductions, Situation Code Combinations, will be included in the Report allowed by the report user security profile.

The report can be exported in HTML, PDF, MS Excel, RTF and MS Word formats, prior to printing, using the ![]() ,

,  ,

,  ,

,  , and

, and  icons.

icons.