Generation of the Report

Overview

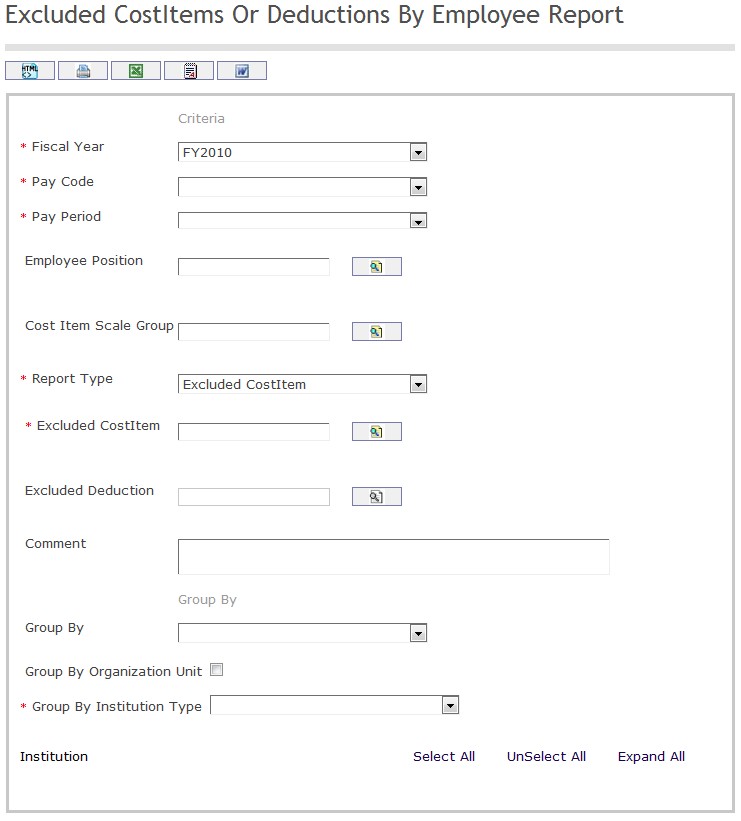

The Excluded Cost Items/Deductions by Employee report allows the user to visualize active employee assignments who do not have the selected Cost Items and /or Deductions for the selected Pay Period.

To GENERATE an Excluded Cost Items/Deductions by Employee Report, follow the steps below:

Navigation

The Excluded Cost Item / Deduction Per Employee Report includes the following filter criteria available for the report:

- Fiscal Year - Select Fiscal Year from drop-down menu

- Pay Code - Select Pay Code from drop-down menu

- Pay Period - Select Pay Period from drop-down menu

- Employee Position - To enter the Employee Position, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Employee Position list, then select the Employee Position

to retrieve the Employee Position list, then select the Employee Position - Cost Item Scale Group - To enter the Cost Item Scale Group, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Cost Item Scale Group list, then select the Cost Item Scale Group

to retrieve the Cost Item Scale Group list, then select the Cost Item Scale Group - Report Type - Select Report Type from drop-down menu

- Excluded Cost Item - Excluded Cost Item - To enter the Excluded Cost Item, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Excluded Cost Item list, then select the Excluded Cost Item

to retrieve the Excluded Cost Item list, then select the Excluded Cost Item - Excluded Deduction - To enter the Excluded Deduction, (optional field) click on the Lookup icon

, click on Find icon

, click on Find icon  to retrieve the Excluded Deduction list, then select the Excluded Deduction

to retrieve the Excluded Deduction list, then select the Excluded Deduction - Comment - Add additional comments

- Enter Group By information

- Group By - Select Group By from drop-down menu

- Select Group By Organization Unit

- Group By Institution Type - Select Group By Institution Type from drop-down menu

If all filter criteria are left blank, all Employee Positions, Cost Item Scale Groups, Excluded Cost Items, Excluded Deductions will be included in the Report allowed by the report user security profile.

The report can be exported in HTML, PDF, MS Excel, RTF and MS Word formats, prior to printing, using the ![]() ,

,  ,

,  ,

,  , and

, and  icons.

icons.